Czech government announces support for electric car gigafactory – 64km away from EMH’s lithium project

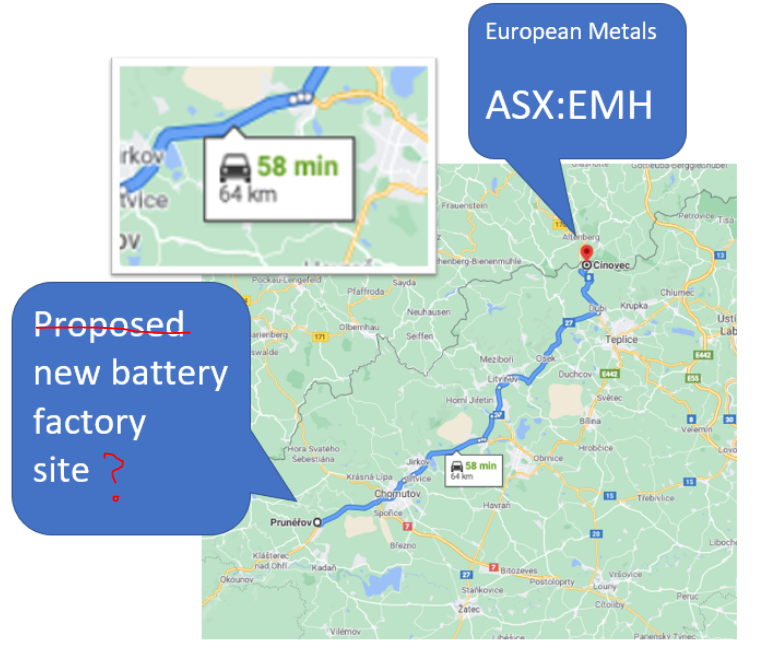

We said it in June when commenting on the share price rise of European Metals Holdings Ltd (ASX: EMH; AIM: EMH; NASDAQ: ERPNF) – an electric vehicle battery factory was mooted to be in the pipeline, likely to be situated just 64km from EMH’s lithium project.

EMH is developing the largest hard rock lithium resource in the EU at its Cínovec project in the Czech Republic, and the company is our third European battery metals investment.

We invested in EMH at $1.40 in March this year, but it hasn’t had a share price run yet like our other European battery metal investments VUL ( +2,375%) and EMN (+207%).

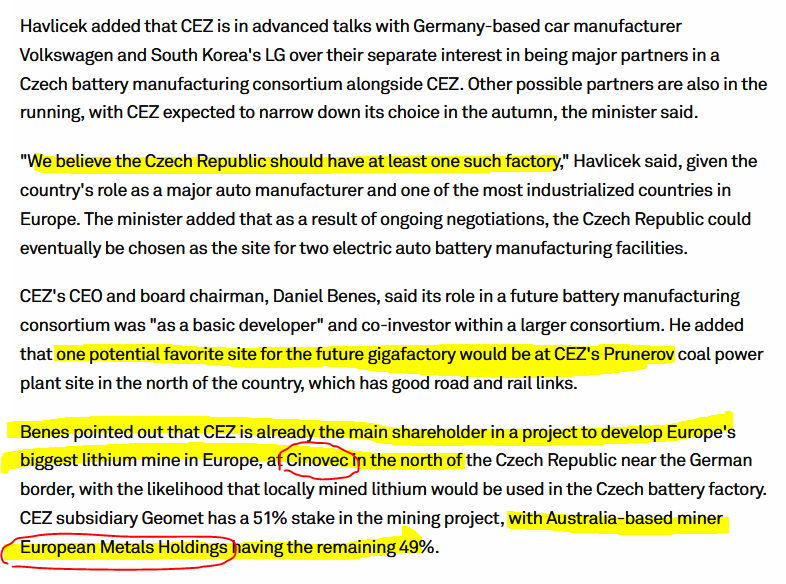

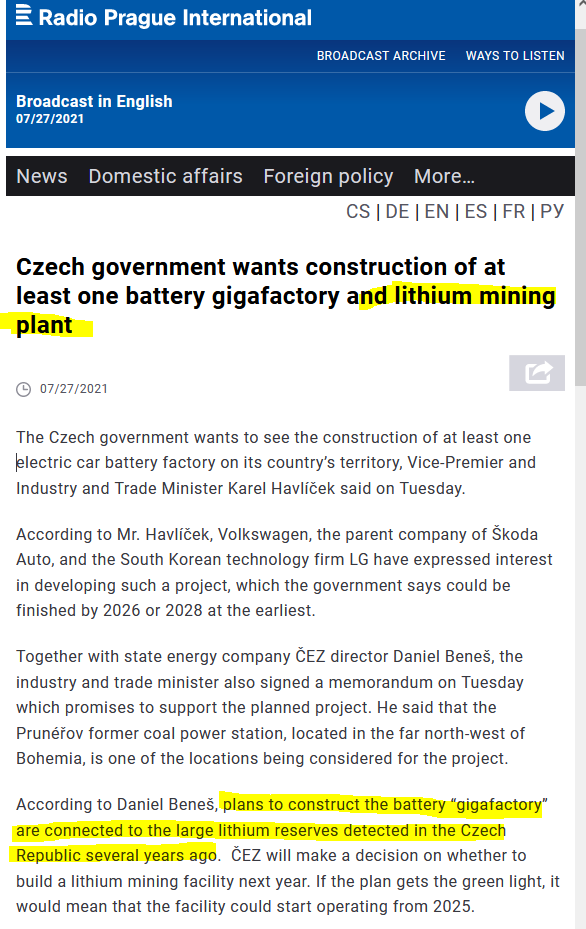

Just overnight we learned that the Czech Ministry of Industry and Trade and the country’s dominant power company CEZ, signed “an agreement over plans to attract a gigafactory for electric car batteries to the country”.

In our June commentary we reported on rumours that a battery gigafactory was being discussed on a site just 64Km away from EMH’s lithium project…

EMH’s lithium project is less than an hour drive from the proposed site of this new battery factory:

BREAKING NEWS: Overnight mainstream media reported that the Czech government and CEZ (EMH’s 51% project partner) have signed an agreement to provide significant incentives to secure this proposed battery factory:

Stepping back to June, according to local media, VolksWagen and EMH’s project partner CEZ were talking about building an electric vehicle battery factory.

Stepping back to June, according to local media, VolksWagen and EMH’s project partner CEZ were talking about building an electric vehicle battery factory.

Joining the dots, we figured that this would put EMH another step closer to forging offtake agreements.

Europe has ZERO local lithium supply and the EU is desperate to change this, which is why we like European battery metals investments.

The EU is going to need more lithium than it can source – and hopefully soon we will see EMH on the ‘offtake agreement podium’ after Vulcan Energy Resources (ASX:VUL) inked an offtake deal with LG just 10 days ago.

We invested in EMH at $1.40. Here is our original initiation article.

EMH hasn’t had a big run yet, but we hope an offtake agreement will help with that.

The industry dynamics are unquestionably compelling with demand for battery metals ramping up substantially over the coming decade supported by government energy reforms and an auto and power industry primed to take advantage of what is shaping up as a new wave “industrial revolution”.

VolksWagen has recently outlined its ambition to enter the battery raw material market – and wants to build six gigafactories in Europe by 2030 – here is our commentary on how this will impact EMH.

Czech automaker Skoda is owned by VolksWagen and is seeking a local gigafactory in Czechia – and as we can see from the news reports above, negotiations appear very advanced on this news.

This is good news for all EU battery metals stocks and even better for EMH, as VolksWagen is pushing for a local battery gigafactory supplied by local lithium sources.

Czech Government: Multi-billion dollar support to attract battery factory

Industry minister Karel Havlicek said in an accompanying press conference that the Czech government was prepared to give direct and indirect state support “worth several billion koruna” to help land the factory in which investment will total at least koruna 52 billion ($2.4 billion) with battery production capacity of at least 40 GWh/year and up to 55 GWh/year.