Management changes at FOD – We continue to hold

We are invested in Food Revolution Group (ASX: FOD) – a food and beverage manufacturing company specialising in innovative health-focused products.

FOD’s flagship product is premium orange juice that is selling in major supermarkets – you might have seen their “Original Black Label” juice in your weekly shopping at Coles and Woolworths:

FOD is also starting to gain traction with new products like their “wellness juice shots”, with the products appearing on the shelves at Coles and Woolworths over the last few months.

When we started looking into FOD, we were attracted to the low share price that seemed to be lagging behind the company turnaround job that had been taking place.

We invested in FOD after watching its new turn-around CEO Tony Rowlinson run the show for 12 months and start to execute on a turnaround strategy for FOD: growing the business, increasing efficiencies and delivering innovative new products.

We tried to time our entry into FOD just as it was on the cusp of seeing the first results of “Turnaround Tony’s” first 12 months of effort.

We invested in FOD at 3.5c in March this year thinking we had picked the bottom, but despite delivering a great March quarterly report, FOD is currently trading below our entry price at 2.8c after what we suspect is some weak hands selling after the last placement in March.

We made our investment in FOD with a 4 to 7 year horizon – our next step is to visit the juice factory and see where it all happens. We will cover our findings in an updated research report once the site visit is complete.

What’s been happening with FOD?

On Monday, FOD caught us by surprise and announced a key management change.

FOD announced CEO Tony Rowlinson had resigned and the company’s CFO Steven Cail has taken the reins.

Usually it’s not good news when you see a sudden CEO departure, but in the last 24 hours we have spoken to the new CEO Steven and we also caught up with outgoing CEO Tony – and after hearing from both of them we are satisfied with the proposed transition.

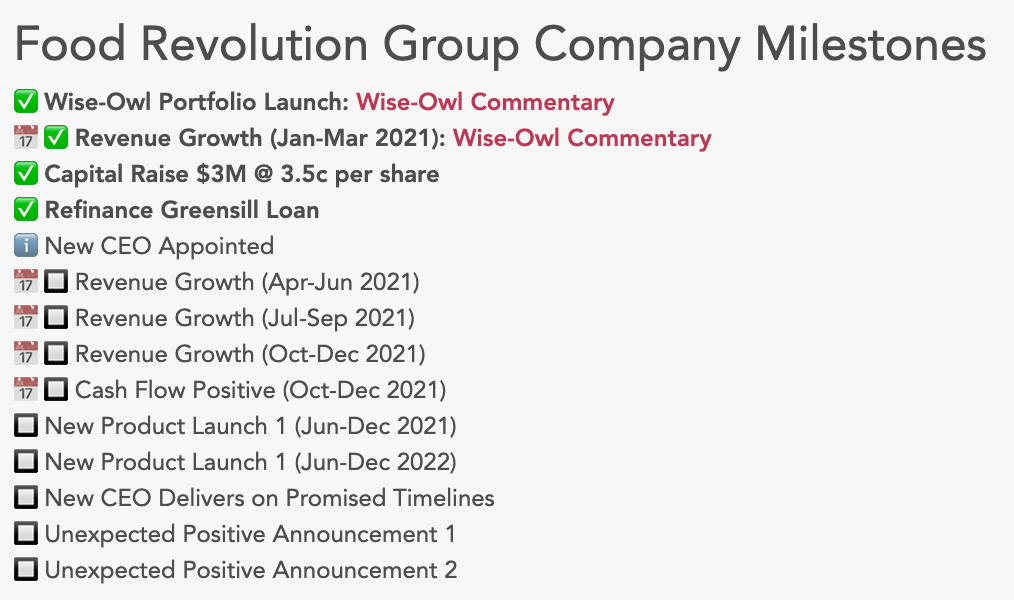

We have formed a view that the business now has a strong foundation for growth and we are watching closely to assess how well new CEO Steven executes on the company milestones we are expecting for our investment in FOD.

NEW: Here are the milestones we want to see delivered by FOD:

We want to see if new CEO Steven can build investor trust by executing on a few near term milestones.

Here is what we want to see from FOD:

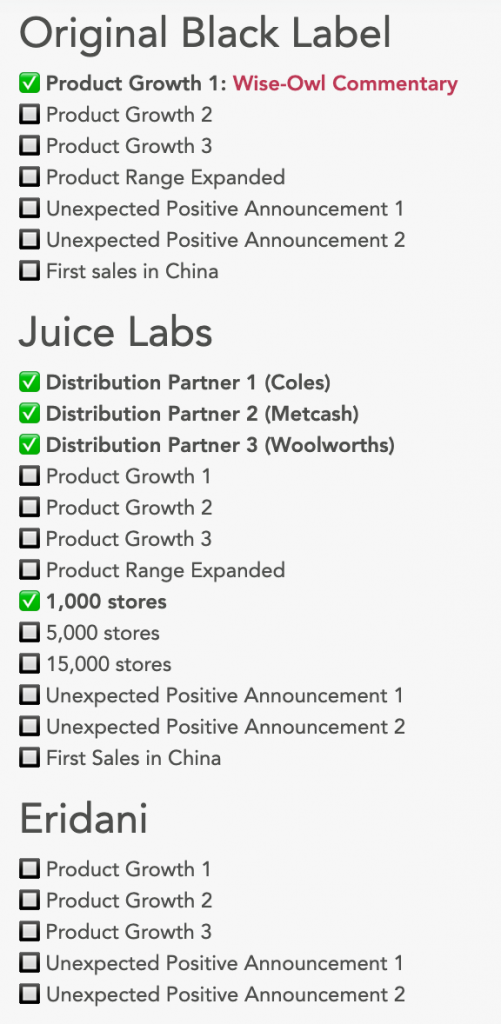

We have organised our expected FOD milestones across the 3 key product initiatives (Black Label OJ, new Juice Labs shots and Eridani) and also general company progress (corporate and financial).

Green ticks show what has already been achieved by Tony since we invested and the rest are the milestones we expect to see. Near term milestones we hope to see from Steven will be highlighted in our next note, click to see them on our FOD company page: