Overview: Vulcan Energy Resources Ltd (“Vulcan”, “the Company”) is an Australian mineral exploration company focused on exploring and developing battery metals projects in Europe. The Company’s primary asset is the Vulcan Lithium Brine Project in the Upper Rhine Valley of Germany. The Project has a Total Indicated and Inferred Mineral Resource of 13.95 Mt of contained Lithium Carbonate Equivalent, at a lithium brine grade of 181 mg/l Li, making it Europe’s largest JORC-compliant lithium resource. The Company’s vision is to produce the world’s first, premium Zero Carbon Lithium™ hydroxide product by 2023. Vulcan is dual-listed on the Frankfurt Stock Exchange, trading under the code “6KO”.

![]()

Catalysts: Vulcan owns Europe’s largest lithium brine resource, in center of the fastest-growing lithium market, with potential future upside across its five license areas. Following the completion of the Maiden Resource estimate and Scoping Study in just five months, fast-track development of the project is underway with a targeted completion of the Pre-Feasibility Study (PFS) later this year. Vulcan has signed a Memorandum of Understanding with a German geothermal operator to fast-track production from existing infrastructure. As the Company advances the project, securing off-take & financing agreements are major catalysts.

Hurdles: Vulcan is at an early stage of its resource development and considerable further technical investigations are required to de-risk the project. Procuring finance remains a key aspect for the implementation of the zero-carbon project in the Upper Rhine Valley and there is no guarantee that funds can be procured at favourable terms. The approval process presents numerous regulatory hurdles at various stages.

Investment View: Vulcan offers exposure to demand lithium in the European Union, the world’s fastest-growing market for lithium. We are attracted to the magnitude and quality of the Vulcan Lithium Brine Project, proximity to existing infrastructure, and access agreements in place. Procurement of funding and regulatory hurdles are principal risks. Vulcan appears well-positioned to play an integral role in the European Union’s plan to establishing a consistent European supply chain of lithium hydroxide. Management has a strong track record of value creation and deep experience in developing geothermal brine projects, thus appears well equipped to advance a project of such magnitude. With a vision to deliver a project with a CO2 footprint of zero, Vulcan targets the production of lithium hydroxide by 2023, preceded by a number of high-impact value drivers and key milestones. Therefore, Wise-owl initiates coverage to monitor Vulcan’s progress in advancing the project.

Vulcan Energy Resources Ltd is an Australian mineral exploration company focused on exploring and developing battery metals projects in Europe. The Company’s primary asset is the Vulcan Lithium Brine Project in the Upper Rhine Valley of Germany. The Project has a Total Inferred Mineral Resource of 13.2 Mt of contained Lithium Carbonate Equivalent, at a lithium brine grade of 181 mg/l Li, making it Europe’s largest JORC- compliant lithium resource.

In July 2019, Australian company Koppar Resources Limited signed an agreement to acquire 100% of Vulcan Energy Resources, owner of the Vulcan Lithium Brine Project in South Germany. The Company subsequently changed its name to Vulcan Energy Resources Ltd (ASX:VUL), highlighting the new direction of the company. Vulcan is dual-listed on the Frankfurt Stock Exchange, trading under the code “6KO”.

A global shift away from fossil fuels is leading to a boom in lithium-ion battery applications, ranging from electric vehicles (EVs) to energy storage systems

Electric vehicle systems are projected to become the primary solution for mobility development in the future. The lithium-ion battery is the fastest-growing battery system and currently the most suitable energy storage device for powering EVs owing to its attractive properties. There are other technologies available but the lithium component is indispensable for all battery technologies that are currently industrially relevant.

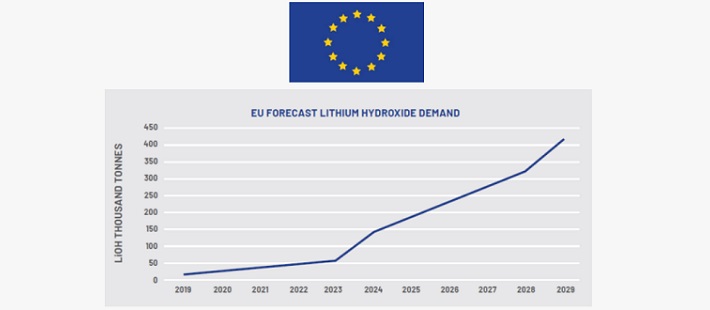

In Europe, many countries including Germany have aggressive greenhouse gas emissions and climate targets, and there is now a concerted push towards establishing a globally relevant lithium-ion industry. While Europe is the world’s fastest-growing lithium market, there is currently virtually zero local supply.

Europe remains heavily reliant on lithium supply from China and South America, and industrial policy ambitions are therefore aimed at establishing a consistent European supply chain. Institutions involved have announced multi-million euro grants to foster lithium-ion battery ventures, secure resources, and build mega-factories.

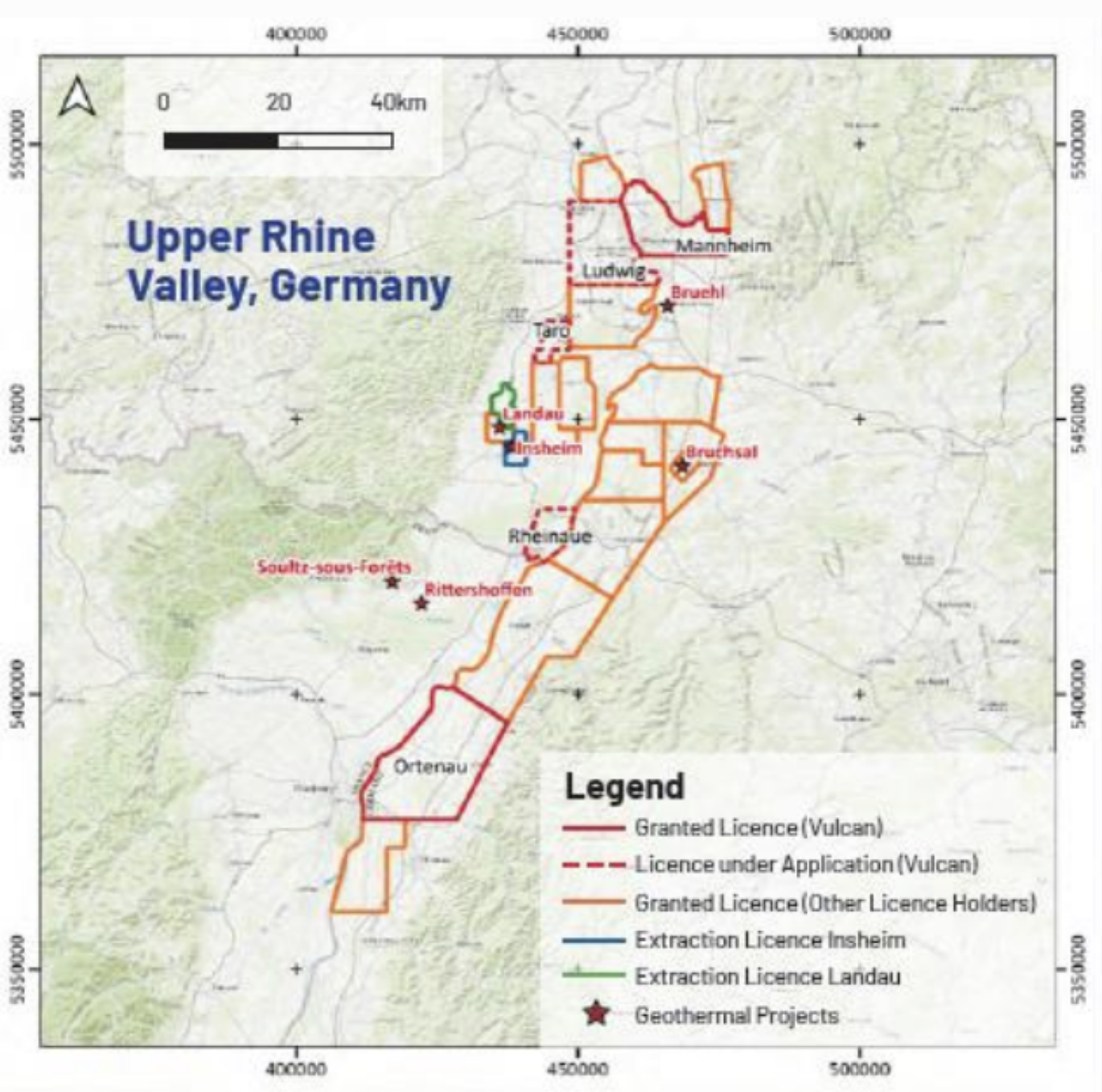

The Vulcan Lithium Brine Project is situated in the Upper Rhine Valley in southwest Germany, east of the Rhine and in close proximity to Stuttgart, the capital of the federal state of Baden-Württemberg. The area is uniquely endowed with lithium-rich hot brines.

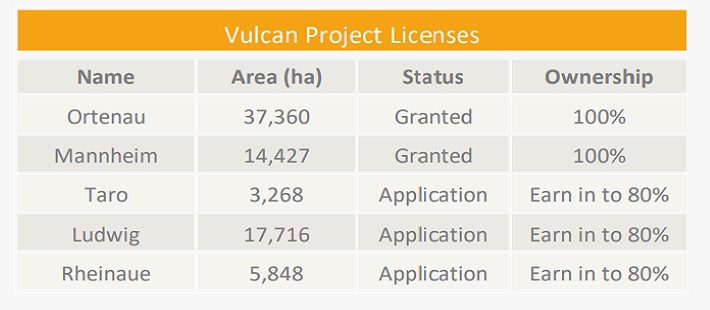

The project comprises two granted exploration licenses (granted in the first half of 2019), and three license applications covering a total area of approximately 78,600ha. The brine field has been extensively studied due to its geological and geothermal characteristics with readily available seismic and drilling data for resource evaluation. The thermal water in the Upper Rhine Valley has a content of up to 210 mg/l. The only other known geothermal field with similar lithium grades and a similar flow rate is Salton Sea, California.

The Project has a Total Inferred Mineral Resource of 13.2 Mt of contained Lithium Carbonate Equivalent, at a lithium brine grade of 181 mg/l Li, making it Europe’s largest JORC-compliant lithium resource. VUL plans to extract lithium from brine using geothermal power, via a process that generates zero net carbon emissions.

A number of agreements are already in place to support Vulcan in advancing the project.

In November 2019, the Company signed a Memorandum of Understanding (MOU) with German geothermal operator Pfalzwerke geofuture GmbH (Pfalzwerke). Pursuant to the MOU concluded, Vulcan Energy Resources will base the pilot plant for lithium production at a geothermal power plant already in operation. The agreement will likely shorten the exploration and construction process of the geothermal power plant.

In May 2020, Vulcan signed a binding agreement with InnoEnergy to assist Vulcan with securing project funding, driving relationships, and obtaining and fast-tracking necessary licenses. InnoEnergy is supported by the European Institute of Innovation and Technology (EIT), a body of the European Union.

Following the completion of the Scoping Study in February 2020, Vulcan will now commence the Pre-Feasibility Study – due for completion later this year – ahead of the Definite Feasibility Study (DFS) in 2021.

Various cost advantages due to the location as well as geological factors point to the economic viability of Vulcan’s lithium project in the Upper Rhine Valley.

Brine lithium production is relatively cost-effective compared to hard rock. The infrastructure for lithium separation requires lower investments and less working capital. While the European Union has only small or complex hard-rock projects, we see strategic merit in Vulcan’s proposition.

The exploration of the lithium reserves in the Upper Rhine Valley, on which geological data is available, is already a process involving a low level of complexity based on data that is already available. This will simplify any future mining campaigns.

In addition, the location of the Upper Rhine Valley and immediate proximity to commercial customers offers various advantages with respect to costs as well as the environmental footprint. The transportation distance to existing or planned battery factories will allow Vulcan to run a comparably low-capital production process.

Combined with the substantial size and attractive grade of the resource, the project makes a compelling case that should assist Vulcan in procuring offtake and finance arrangements to advance the project.

The scoping study (February 2020) conducted by Vulcan Energy Resources on lithium mining in the Upper Rhine Valley used publicly available price assumptions, based on models that forecast an increase in supply, demand, and inventories. According to Fastmarkets the spot price for lithium hydroxide (56.5% battery grade) was in the range of USD 10.00/kg to USD 11.50/kg (cif China, Japan, Korea).

Commercial production is forecasted to occur in two stages: Stage 1 will involve a small commercial plant to be built at an existing geothermal operation, a low capex model. Stage 2 will involve the construction of Vulcan’s own wells and geothermal plants. Vulcan has established a model that forecasts dual revenue potential from the project.

However, raising the required capital remains a key aspect for the implementation of the project, with funds in excess of USD 50 million likely required for Stage 1.

Vulcan entered into an early MOU access agreement to fast-track the development of the project, and establishing the joint venture with power plant operator Pfalzwerke will be subject to a final contractual agreement.

Following the completion of the Maiden Resource estimate and Scoping Study in just five months, fast-track development of the project is underway, targeting completion of the Pre-Feasibility Study (PFS) later this year. As the Company advances the project, securing off-take & financing agreements are major catalysts.

Vulcan seeks to unlock value from its lithium hydroxide project in South Germany and offers investors exposure to demand lithium in the European Union, the fastest-growing market for lithium. We are attracted to the magnitude and quality of the Vulcan Lithium Brine Project, proximity to existing infrastructure, and access agreements in place. However, Vulcan is at an early stage of its resource development and considerable further technical investigations are required to de-risk the project, while procurement of funding and regulatory hurdles are additional risks.

Vulcan appears well-positioned to play an integral role in the European Union’s plan to establishing a consistent European supply chain of lithium hydroxide. With a vision to deliver a project with a CO2 footprint of zero, Vulcan targets the production of lithium hydroxide by 2023, preceded by a number of high-impact value drivers and key milestones.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.