Crowd Media Holdings Limited (ASX:CM8; FWB:CM3) is a tech-based, vertically integrated social commerce business selling unique state-of-the-art products and services that are integral to the lives of its customers.

The group’s products are sought after predominantly by younger audiences (Gen Z and Millennials) mainly across Europe, and in keeping with the group’s history, its technologies are accessible in more than 12 languages. (DC: we reduced our scope as part of the restructure)

Crowd Media has long been considered a pioneer in influencer and social media marketing, leveraging influencers on a global basis with its own in-house products, a strategy that has evolved from a mobile technology and media company to a global social media house where campaigns can be executed with the local market knowledge and cultural expertise.

The acquisition of a strategic stake in Forever Holdings Ltd was a touchstone development for CM8 as it supported both the thinking around the conversation commerce science and the vehicle that will eventually culminate in the product that management views as the Holy Grail of influencer marketing.

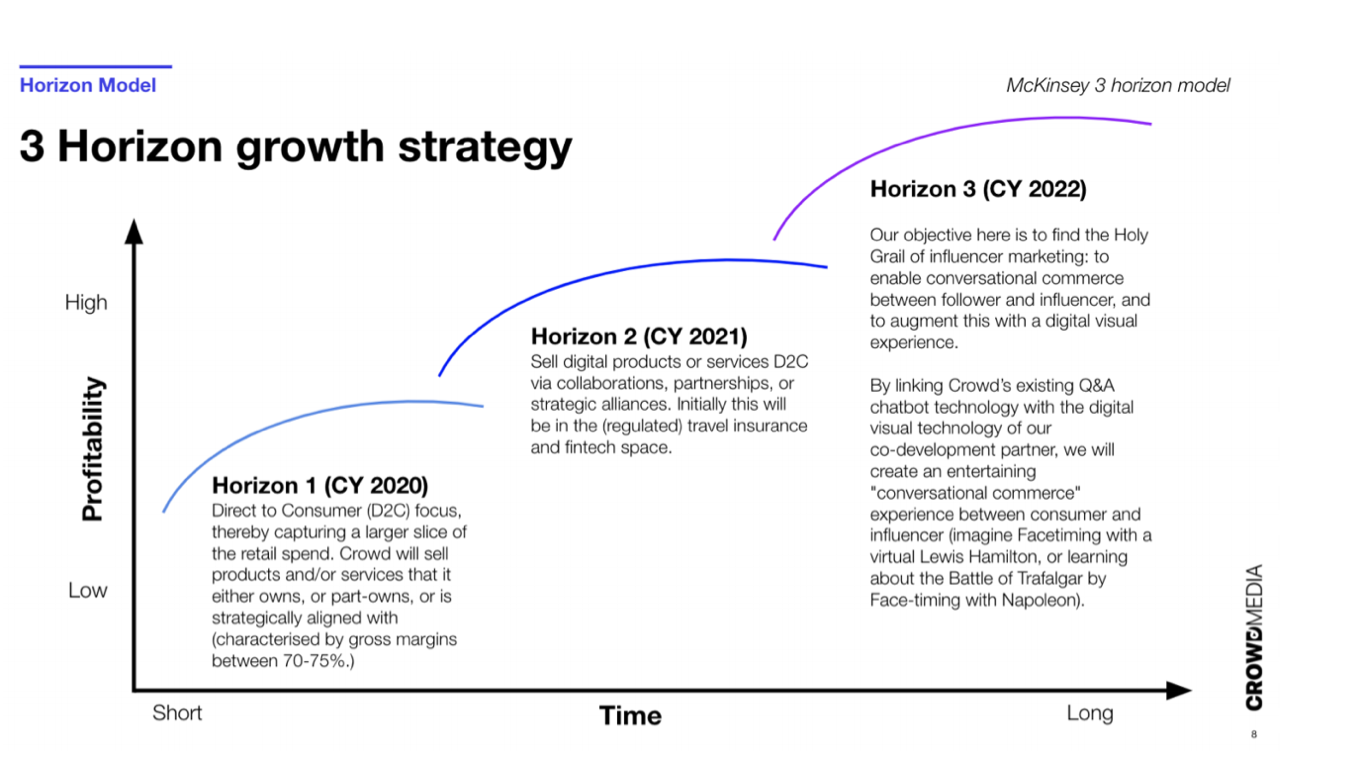

In reference terms, this is CM8’s horizon three objectives, the third leg of its growth strategy which it aims to achieve by 2022.

This encompasses the enabling of conversational commerce between the follow-up and the influencer, augmented by a digital visual experience.

By linking CM8’s existing Q&A chatbot technology with the digital visual technology of its co-development parties, the company plans to create an entertaining conversational commerce experience between consumers and influencers.

In practical terms, management poses the potential experience of face timing with a virtual Lewis Hamilton or learning about the Battle of Trafalgar by face timing with Napoleon.

CM8 provided an interesting touch and feel an example of what this technology might look like in a one-on-one conversation with Gustav Eiffel who built the Eiffel Tower

https://youtu.be/gGQmeRip1rQ

The Horizon 3 strategy was further accelerated by two new partnership agreements. The first, a 3-year binding Heads of Agreement (HOA) with UneeQ Limited for the creation of “Digital Ambassadors” to help power Conversation Commerce activity and influencer marketing. UneeQ has created an AI-driven platform used across customer support and sales. The terms of the agreement, include Crowd’s first talking head.

Crowd has also executed a binding Heads of Agreement (HOA) to form a 50/50 Joint Venture with Israeli-based VFR Assets and Holdings Ltd.

The agreement brings the companies together to create a platform that will allow the scalable creation of the “talking head” visuals which will power the next wave of conversational commerce and digital influencer one-to-one interactions.

Crowd is investing $250,000 into the JV and will provide access to its AI Chatbot technology and back-office and marketing capabilities, whilst VFR will work on technical and design aspects.

Over a 10-year period, the company has made acquisitions and negotiated collaborative agreements centred around its European expansion strategy. However, it could be argued that a watershed moment in the company’s progress was the shaping of its three-year Horizon strategy in November 2019 that has resulted in the instigation of a more focused business aimed at penetrating high-value markets with more predictability around monetisation as it orchestrates a direct to consumer sales model.

Management’s recent decision to acquire an 8% interest in Forever Holdings Ltd is consistent with the strategy outlined in 2019 as it serves to facilitate a platform that enables conversational commerce between follower and influencer, augmented with a digital visual “talking head” experience.

Market moving developments: The Forever Holdings transaction is the most recent and one of the more important material developments for some time. Forever Holdings Ltd is a global leader in the technology required to support Voice-and-Visual Interactive Digital Media. To date, its technology has been used to preserve the stories and experiences of real people by producing interactive digital recreations wherein those people can enter into a virtual ‘Facetime’ conversation, and answer questions on a one-on-one basis.

With this ability to enable leading talent to connect with followers through voice and video across multiple platforms, Forever Holdings is at the forefront of this digital frontier and is supported by InnovateUK, the UK government’s innovation agency. Forever Holdings’ work is beyond proof-of-concept, with existing applications deployed across multiple platforms including mobile and life-size installations, including at a German Holocaust museum.

Underlining the importance of its revised strategy is the surge in the company’s share price which has nearly doubled from 2.2 cents on the day prior to the announcement to a 12 month high of 4.2 cents.

However, it is also important to note that there has been significant support for the company on the back of much improved financial news at the half-year and full year marks, highlighted by its fiscal 2020 transition to a positive underlying EBITDA which management expects to build on in fiscal 2021.

There is evidence that management can deliver on this expectation following a 136% increase in Crowd Direct revenue in the September quarter.

Catalysts: There are a number of catalysts on the horizon, but from a broader perspective it is worth noting that Crowd Media has flown under the radar for some time now and the company is likely to get a material boost from demonstrating its capacity to sustain a strong financial turnaround. Management expects its Crowd Direct business to deliver record quarterly revenue in the December quarter, a milestone that should highlight the group’s turnaround.

As we will flesh out later, Forever Holdings is likely to be a source of constant news as development opportunities across the music, celebrity, and educational sectors are realised. Crowd Media should also benefit from its leverage to the fintech and insuretech sectors in 2021 with the latter benefiting from a return to normal activity in the travel sector.

During fiscal 2020, Crowd Media on-boarded four new brands, including British beauty brand, London Labs, and German fashion house, I Am Kamu. As consumers recommence normal outdoor activities in 2021 there should be increased activity across the fashion industry. The company also on-boarded natural, home cleaning products group KINN Living, as well as the Vital Group, a British brand builder that is active across a number of sectors including healthcare, consumer, and water purification. The financial benefits of these collaborations are likely to flow through in CY 2021.

Management said that it expects to announce a further six new brand deals in fiscal 2021, and as investors realise the revenue generation that these type of deals deliver their execution could result in more significant share price momentum than has been the case in the past. This is on top of the recent additions of Teadora and MDComplete brands.

https://www.youtube.com/watch?v=Ufi7lrtvkzA&feature=youtu.be

Consequently, Crowd Media should be viewed as a company that benefits greatly from reinventing itself, resulting in material operational investments being better appreciated by the investment community.

Hurdles: As is the case in the broader technology industry, remaining nimble and alert to new developments, as well as being able to quickly adapt to change is a challenge. However, management has demonstrated its ability to align with high-profile and emerging technologies and brands, suggesting it can respond positively to such developments. The group’s Q&A mobile division business is a good example of how a changing landscape can impact performance, while also being an insightful example of management’s ability to respond to such challenges.

In this area of the company’s business, management has witnessed a decline in the use of SMS as a paid-messaging platform by its target audience. This trend has been accompanied by continued material regulatory headwinds, resulting in softer mobile revenues in fiscal 2020.

In response, management has stabilised this area of the group’s business, even getting it to the point where it is generating small monthly profits again, despite the fact that the decline in paid-SMS messaging over time is inevitable.

With a view to mitigating this trend, management is working on technology that will enable its Q&A messaging to work, as well as being monetised on other platforms such as WhatsApp or Messenger. This technology is the basis of the group’s ‘conversational commerce’ concept that management sees as a significant earnings driver. Consequently, the group is successfully turning adversity into opportunity, something that management should be applauded for.

A further hurdle is CM8’s current and non-current borrowings of $3.6M on 30 September 2020. While owed parties have expressed willingness to extend or convert facilities, this could affect valuation with the majority of the Convertible Notes (which are treated as debt on the Balance Sheet) being held by the board and those close to the Chairman.

Investment View: Significant investment has been made in technological development and building relationships, positioning the company to generate substantial revenue growth in coming years. From an investment viewpoint, evidence that the group’s financial turnaround, in particular, its ability to monetise its products is a key takeaway.

The benefits that flow from the group’s stake in Forever Holdings cannot be understated as they have the potential to positively impact a broad range of the company’s operations. This dialogue can function on Crowd’s AI-driven Q&A Chatbot technology platform, across multiple languages.

By combining Crowd’s Chatbot technology with Forever’s digital voice and visual projections the group can significantly accelerate the development of its ‘talking head’, effectively opening up numerous commercial opportunities across entertainment, sport, influencer marketing, health, and educational fields.

Crowd Media’s technologies are pitched at Generation Z and Millennials, regarded as high disposable income demographics. This should assist the company in terms of delivering both robust and predictable growth, particularly given the strong reliance on Crowd Media-type technologies by consumers in those demographics.

Consequently, the company presents as a right time, right place story with a revitalised management team that has the potential to take advantage of emerging technologies rather than being hamstrung as the landscape inevitably changes.

Niche Products Targeting a Cashed-Up Tech-Hungry Demographic

Crowd’s financial and strategic turnaround began in September 2019 as the new board and management established a clear vision to reposition the group as a tech-based media company with a focus on conversational commerce.

As a vertically integrated social media e-commerce business selling a growing number of products, one could point to numerous current and potential revenue streams, but for ease of understanding, they could best be summed up as the Direct to Consumer Division and the Mobile Division with the former focusing on selling exemplary products that are strategically aligned with its digital platform, a transition from the previous model which positioned the company as a fee earning agency for external brands.

Direct to Consumer Division

The newly created Crowd Direct division generated revenues of $350,000 from a standing start during fiscal 2020. In the last few months of the financial year, three new brands were tested, namely, I Am Kamu, London Labs, KINN Living, and Vital Innovations with the latter being very timely in a COVID and post-COVID environment.

Crowd Media executed an exclusive and binding Marketing Services Agreement with London-based VITAL Innovations Ltd to market and sell key VITAL portfolio brands and products into the European market, excluding the UK.

Founded 40 years ago, VITAL is a UK-domiciled family-owned business that has created and launched a number of successful brands across a number of sectors including healthcare, consumer, and water purification sectors.

VITAL’s portfolio brands are particularly well suited to the promotional strategies that Crowd Media can offer because their target customer is almost always a millennial, perfectly matched to the group’s social media and influencer marketing skills.

This will provide Crowd Media with a significant position in the health and wellness industry, one of the key sector’s management is focusing on in fiscal 2021 given the substantial emphasis on home care, hygiene, and health products.

Mobile Division

The Q&A segment of Crowd Media’s mobile division experienced a decline in the use of SMS as a paid messaging platform. This trend was accompanied by regulatory challenges.

The subscription segment of the mobile division also faced substantial regulatory headwinds, but management was able to combat this trend with the launch of a number of new products and entry into new countries.

Consequently, revenue for fiscal 2020 was up 10% compared with the previous corresponding period, and management expects that segment to remain profitable in fiscal 2021.

Forever Holdings Limited

Forever Holdings Limited presents as basically an ‘asset’ in its own right because of the breadth of technologies it spans, its wide audience appeal and its compatibility with such a comprehensive range of Crowd Media’s technologies and brands.

As a global leader in the Voice-and-Visual Interactive Digital Media its technology have been used to preserve the stories and experiences of real people by producing interactive digital recreations wherein those people can enter into a virtual ‘Facetime’ conversation, and answer questions on a one-on-one basis.

With this ability to enable leading talent to connect with followers through voice and video across multiple platforms, Forever Holdings is at the forefront of this digital frontier and being supported by InnovateUK, the UK government’s innovation agency is advantageous.

The ability of its dialogue to function on Crowd’s AI-driven Q&A Chatbot technology platform, across multiple languages is a distinct advantage that will benefit the company’s other divisions.

By combining Crowd’s Chatbot technology with Forever’s digital voice and visual projections the company can significantly accelerate the development of its important “talking head” technology.

This will open up opportunities across key categories that interest the group’s core demographics, including entertainment, sport, influencer marketing, health, and education.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.