Overview: Crowd Mobile Limited (“Crowd Mobile”, “the Company”) is an Australian technology company focused on mobile software and mobile marketing services. Its principal asset is a Question and Answer platform (‘Q&A’) and a mobile payments network spanning 160 telco carriers, 54 countries, and 30 languages. In addition, the Company launched a new division, Crowd Media, to take advantage of the growth in digital influencers. We initiated coverage on Crowd Mobile in February 2015 and our last advice was a ‘hold’ recommendation in May 2017.

![]()

Catalysts: Following a $5.4m capital raising in April at a premium to the market, Crowd Mobile has significantly improved its balance sheet, and surplus cash will increasingly be directed to expansion initiatives such as marketing within its rapidly growing Q&A unit. The April placement secured cornerstone institutional support, which is an early validation of its ‘digital influencer’ growth strategy. After a challenging integration period, the Track (aka ‘Subscriptions’) business appears to be stabilising.

Hurdles: Despite the Company’s improved liquidity, its reliance on external capital may not be entirely eliminated. Whilst the performance of the Subscriptions business unit has stabilised, there is no guarantee against further erosion of its earnings base. A lack of growth within the Subscriptions division may challenge Crowd Mobile’s ability to attract an appropriate valuation for its growing Q&A division. Crowd Mobile does not own any patents to its technology and may be subject to increasing competition.

Investment View: Crowd Mobile provides profitable exposure to mobile software and services trends. We are attracted to the Company’s improved balance sheet and capital structure and believe that liquidity can now be reinvested in the business to foster sustainable growth. Whilst risks include recent volatility of the Subscription business and competition, Crowd Mobile’s extensive distribution assets provide a strategic foundation to take advantage of industry tailwinds favouring mobile and social commerce. After updating our forecasts our valuation of $0.29 per share represents a 120%+ premium to recent trade, prompting an upgrade of our recommendation from ‘hold’ to ‘spec buy’.

Nearly two years after its acquisition of Track Holdings, Crowd Mobile’s management has taken the necessary steps to overcome challenges associated with the business.

Whilst the Track acquisition required an undemanding purchase multiple and more than doubled the scale of Crowd Mobile’s distribution infrastructure, poor operational performance within the Track business combined with balance sheet uncertainty drove Crowd Mobile’s share price to all-time lows in 2016.

Crowd Mobile is a turnaround story with cash flow

In this update we highlight turnaround initiatives being executed by management, the consistent growth of Crowd Mobile’s primary asset – its Q&A unit, and longer-term expansion plans. In light of recent capital structure changes, we have also updated our valuation and investment view.

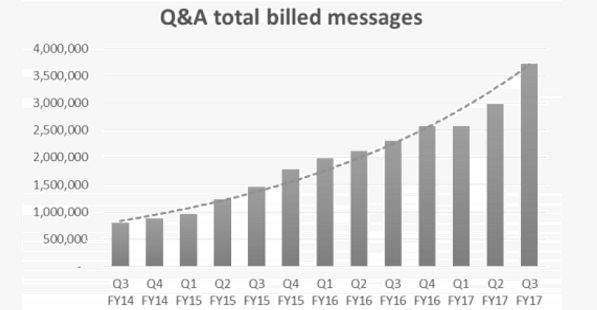

Underneath headwinds stemming from the Track acquisition, Crowd Mobile’s Q&A division has continued to generate free cash flow and witness double-digit growth. The Q&A unit has grown volumes in 11 out of the last 12 quarters – acting as the Company’s ‘beacon of light’ amid restructurings of the Subscriptions unit and balance sheet.

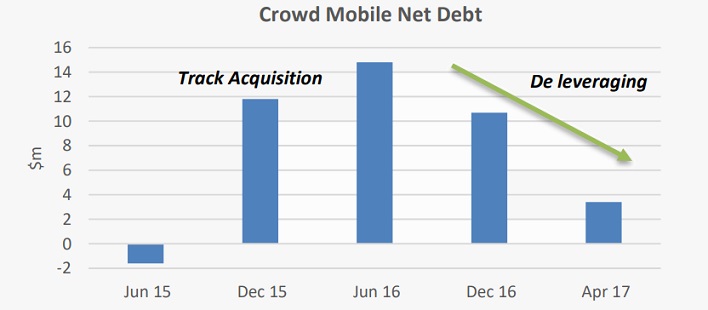

Net debt has fallen by 75%

To address challenges stemming from the Track acquisition, management has jettisoned unsustainable SKU’s within the Subscription unit which were subject to elevated churn and regulatory risk. Whilst a sustained period of normality remains to be demonstrated for the Subscriptions unit, management has indicated the business has now stabilised.

What is most apparent about Crowd Mobile’s turnaround is the improvement in its balance sheet. Debt associated with the Track acquisition has been rapidly retired through a combination of cash flow and equity raisings. Net debt has fallen by 75% since its June 2016 peak, most recently assisted by a $5.4million share placement at $0.13/sh in April 2017.

Executed at a premium to the market, and cornerstoned by Collins St Value Fund, the April placement is a testament to Crowd Mobile’s strong cash generation ability and growth opportunities.

With net debt of $3.4million, or less than 6 months EBITDA as of the April placement, Crowd Mobile is now well-positioned to pursue growth opportunities identified in its core Q&A unit and new initiatives leveraging existing infrastructure.

In the Company’s steadily growing Q&A unit, marketing spend is a primary driver. With reduced debt obligations, an increasing amount of cash flow can be directed towards such investments which have thus far delivered volume growth in 11 of the past 12 quarters.

Although the Track acquisition introduced challenges, underlying distribution assets stemming from the deal remain highly strategic. The expanded m-payments network is helping to drive growth in the Q&A unit whilst also opening opportunities covering social commerce.

Q&A unit has grown volumes in 11 of past 12 quarters

We understand around half the volumes in Crowd Mobile’s Q&A unit are supported by ‘digital influencers’ with substantial social media followings. This is the genesis of ‘CrowdMedia’ – a new initiative designed to help digital influencers further monetise their audience and marketers overcome ad blocking trends to engage with mobile-first consumers.

We note that whilst Crowd Mobile’s existing infrastructure provides valuable support to the CrowdMedia initiative, given its infancy, we have not accounted for this growth opportunity in our updated valuation.

Crowd Mobile’s investment appeal rests in the current and future revenue streams generated by its mobile services portfolio and mobile payments platform.

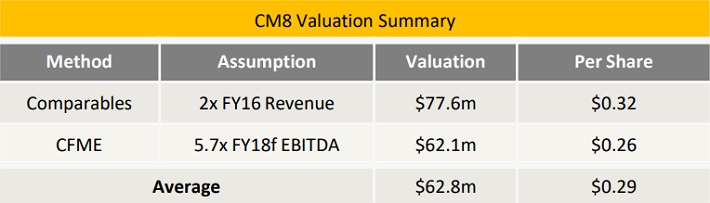

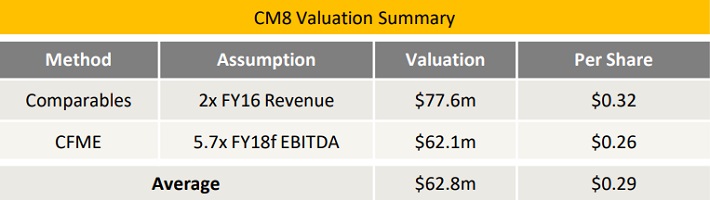

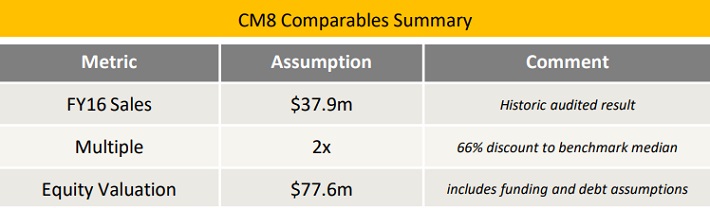

We have considered the Company’s potential worth using the Comparables Method (“Comparables”) and Capitalisation of Future Maintainable Earnings (“CFME”) methodologies. Our appraisal is based on an expanded share count of 242.3 million, reflecting the sum of all existing shares and all options with a strike price < $0.28, expiring in 2018.

Our Comparables approach arrives at a valuation of $77.6million, or $0.32/share. Our CFME method arrives at a valuation of $62.1million, or $0.26/share Applying equal weightings both methods deliver an aggregate valuation of $62.8million or $0.29/share.

Valuation $0.29/share

Assumptions governing both methodologies have incorporated benchmark multiples which have been subject to discounts versus peers. We note that these discounts could provide a source of upside to the valuation should the Company successfully deliver our financial forecasts.

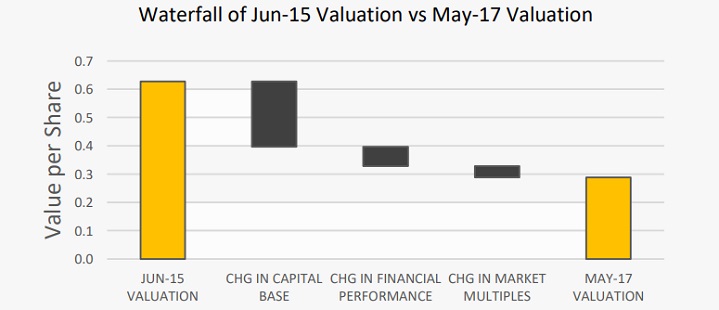

The valuation significantly differs from our previous valuation issued in June 2015 due to a number of reasons, with the key drivers illustrated in the waterfall graphic below. The change in Crowd Mobile’s capital base versus assumptions in our June 2015 model is the largest detractor, followed by differences in the expected financial performance of the Track business and valuation multiples in the industry.

With the Track business stabilising in recent trade and net debt reduced to under $4million, we believe these headwinds have now been largely resolved.

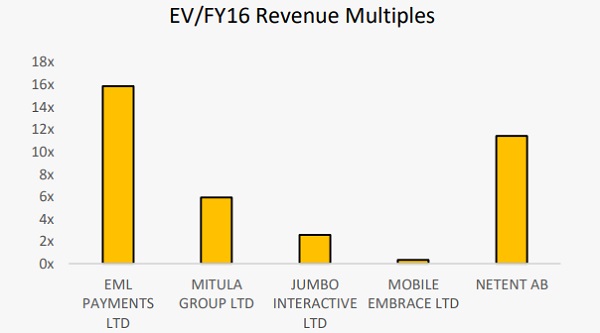

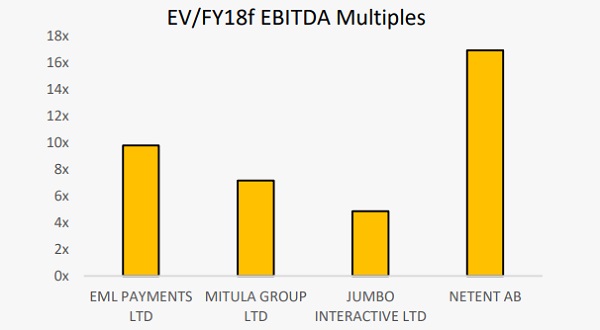

A universe of comparable companies has been assembled which are engaged in the provision of consumer-orientated mobile software services. Price to sales multiples ranges from 0.3x (Mobile Embrace) to 16x (EML Payments) FY16 revenue with a median ratio of 5.9x.

We have applied an arbitrary discount of 66% to the median sales ratio to arrive at a multiple of 2x revenue. The multiple discounts accommodate the combined entity’s limited operating history and large variances between multiples of the benchmark group.

However, we note that this discount could be a source of upside to our valuation should the Company successfully deliver our forecasts over coming periods. Our Comparables approach arrives at a valuation of $77.6million, or $0.32/share.

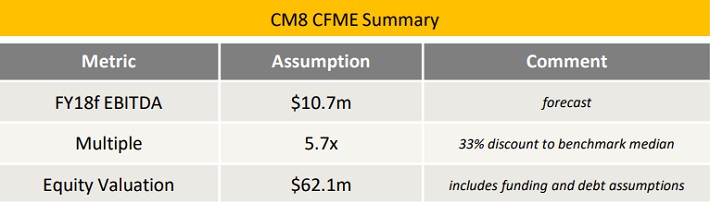

We have projected the Company’s financial performance for the next two financial years to a level that could represent a sustainable earnings capacity. To our estimation of future maintainable earnings, an industry-based multiple has been applied to arrive at a valuation of the Company.

Our forecasts assume ongoing double-digit volume growth in the Q&A unit and stability within the Subscriptions unit. By FY18 we project EBITDA of $10.7million and NPAT of $2.9million, which equates to an EV/EBITDA ratio of 3x and a PE ratio of 11.7x

Current industry trading multiples range from 5x to 19x FY18f EBITDA with a median ratio of 8.5x. To the median, we have applied an arbitrary discount of 33% to accommodate the combined entity’s limited operating history, arriving at a multiple of 5.7x. We note that this discount could be a source of upside to our valuation should the Company successfully deliver our forecasts over coming periods. Our CFME method arrives at a valuation of $62.1million, or $0.26/share.

THE BULLS SAY

THE BEARS SAY

Notes:

EV/EBITDA and PE ratios are based on a diluted share count of 242.3million, net debt of $3million, and option proceeds totalling $4.4million.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.