Overview: Crowd Mobile Limited (“Crowd Mobile”, “the Company”) is an Australian technology Company focused on mobile software and services. Its principal assets include product distribution capability via 60 mobile phone carriers in 25 countries, and proprietary content production capabilities focused on consumer advice. Founded in 2005, the Company listed on the ASX via a reverse merger with Q Limited. Crowd Mobile has entered into a Heads of Agreement to acquire Netherlands-based Track Holdings BV (“Track”). Founded in 2008, Track is focused on the distribution of mobile services via 140 carriers in 38 countries.

![]()

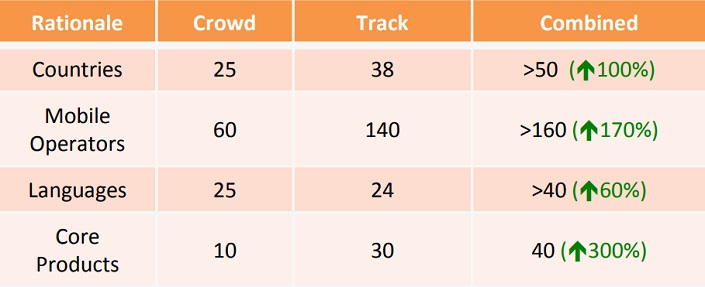

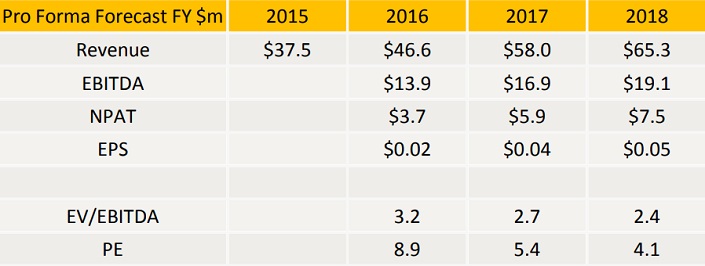

Catalysts: The Track acquisition represents a transformational deal for Crowd Mobile, adding to the Company a strong earnings growth history and immediate scale. Distribution capability in terms of quantity of mobile carriers and geographic presence is forecast to rise 170 percent, and 100 percent respectively. The transaction also delivers a step-change in Crowd Mobile’s financial performance. The track is on course to generate its fifth consecutive year of increased revenue and earnings. Relative to our pre-existing forecasts, pro forma FY16f revenue is scheduled to double, whilst EBITDA is scheduled to be over 4x higher.

Hurdles: Whilst the operations of Track and Crowd Mobile are relatively similar, the scale of this transaction creates integration and funding risks. There is no guarantee forecast synergies will materialise, or that Crowd Mobile can generate returns sufficient to justify and service the required expansion of its capital base. With entry barriers to the industry primarily limited to complexities surrounding the procurement of carrier relationships, Crowd Mobile may face increasing competition.

Investment View: Crowd Mobile provides profitable exposure to the market for mobile software and services. We remain attracted to its established income profile and view the Track transaction to be highly complementary and value accretive. Incorporating Track and associated funding requirements, our valuation has been upgraded by over 50 percent to $0.63/share. Representing a 200 percent premium to recent trade, we maintain our positive view and are upgrading our recommendation to ‘buy’.

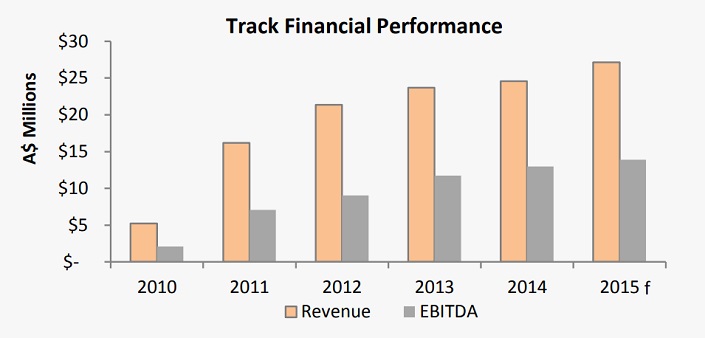

Track is a Netherlands technology Company focused on mobile software and services. Its principal assets include product distribution capability via 140 carriers in 38 countries. Founded in 2008, Track is on course to generate its fifth consecutive year of increased revenue and earnings.

We view Crowd Mobile’s acquisition of track as immediately value accretive and strategically sound. The transaction has an enormous impact on Crowd Mobile’s distribution capabilities, expanding its quantity of telco distribution partners by 170 percent, doubling its national market presence, and increasing language compatibility by 60 percent.

Whereas Crowd’s existing operations have been primarily ANZ and EU focused, Track provides immediate entry into new Asian and South American territories.

Five years of profitable growth

The transaction is forecast to double Crowd Mobile’s earnings margin and priced below three times earnings, represents an attractive purchase multiple.

Immediate synergies available to Crowd which underpin our pro forma earnings projections relate to the Company’s ability to distribute its proprietary content through Track’s distribution channels. Roll out of Track’s payment processing infrastructure across Crowd Mobile’s existing operations also presents a growth opportunity.

Crowd Mobile’s investment appeal rests in the current and future revenue streams generated by its mobile services portfolio. We have updated our forecasts to incorporate the Track acquisition. Relative to our pre-existing forecasts, pro forma FY16f revenue is 2x higher, whilst EBITDA is scheduled to be over 4x higher.

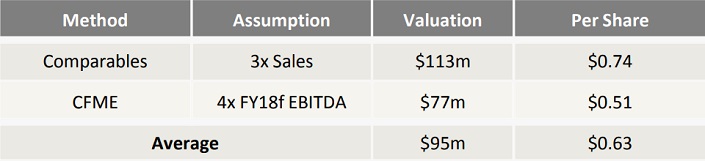

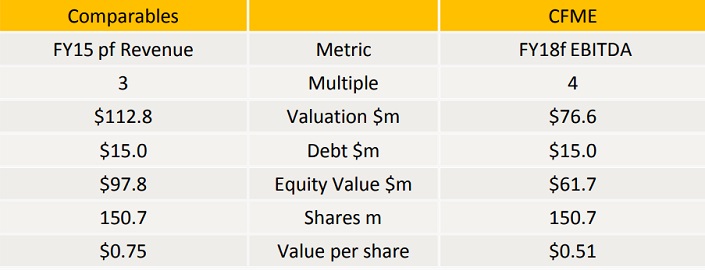

Consistent with our initial February 3rd report, we have considered the Company’s potential worth using a Comparables approach and Capitalisation of Future Maintainable Earnings (“CFME”) methodologies.

Track deal lifts valuation by 50 per cent

Our appraisal assumes the Track acquisition is funded utilising a combination of corporate debt and convertible notes, resulting in a fully diluted share base of 150.7million. The funding mechanisms are assumed to be non-amortising and the average cost of funds is assumed to be 11.25 percent, resulting in interest coverage rising from 4.1x in FY16 to 5.7x by FY18. The convertible notes are assumed to exchange into ordinary shares at $0.40/share.

Our Comparables approach arrives at an equity valuation of $96.5million, or $0.74/share. Our CFME method arrives at an equity valuation of $61.7million, or $0.51/share Applying equal weightings both methods deliver an aggregate valuation of $79.1million or $0.62/share.

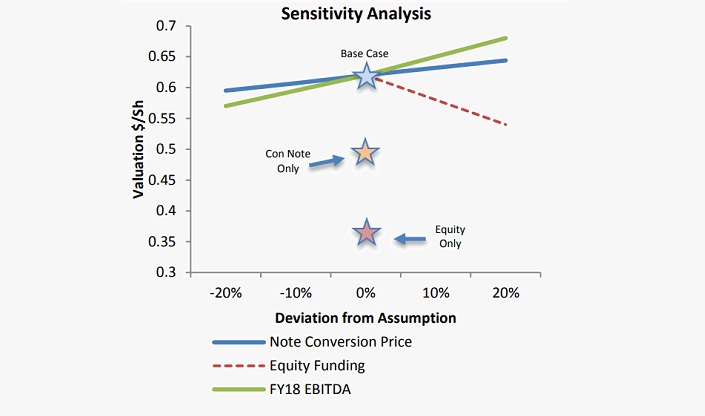

To consider the impact on differences in the funding mix, we have run multiple scenarios as part of a sensitivity analysis. Our valuation is most sensitive to the amount of ordinary equity funding. Every 10 per cent increase in equity funding reduces our valuation by 6 per cent.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.