Iron Road Ltd (ASX: IRD) is the 100% owner of the Central Eyre Iron Project (CEIP), a well advanced, iron ore mining, beneficiation and infrastructure development on the Eyre Peninsula, South Australia.

One of several things working in IRD’s favour is its Board. There aren’t too many boards that have a former BHP Chairperson residing. IRD does and that is ideal for any aspiring iron ore company.

IRD’s project features a world class, coarse grained, magnetite ore body with a 4.5 billion tonne mineral resource and definitive 3.7 billion tonne ore reserve estimate – the largest of any magnetite ore reserve in Australia.

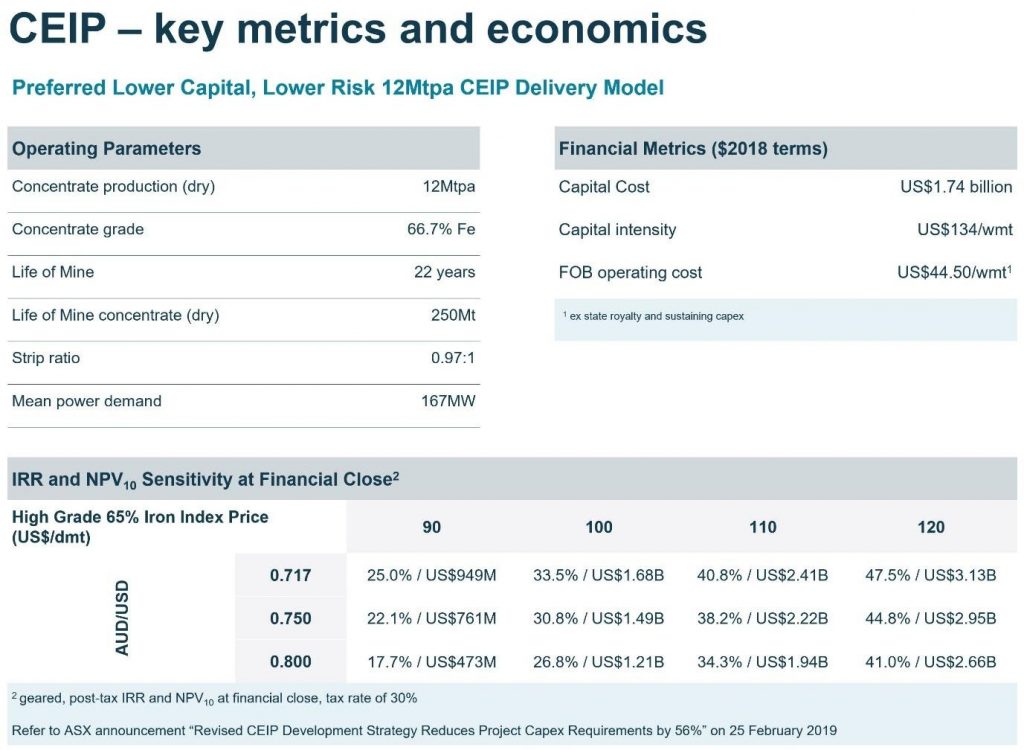

IRD has an annual production target of 12 Mtpa (dry) at a grade of 66.7% iron (considered premium high-grade), over an initial 22 year mine life. The life of mine concentrate is 250 Mt.

IRD’s most recent financial modelling of the project demonstrated a NPV of US$2.6BN. That’s assuming a US$120/dmt price for high-grade iron ore (65% Fe) – which in the current market is a conservative figure, well below recent sustained spot prices over US$200/dmt.

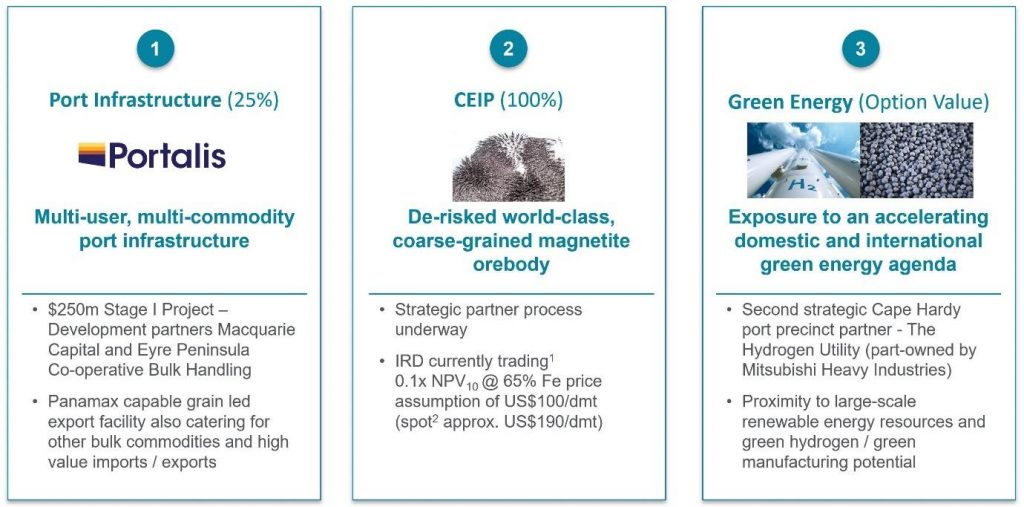

Along with the CEIP, IRD is developing multi-user, multi-commodity port infrastructure, known as Cape Hardy, a valuable asset in its own right given that it will be a port that can handle Capesize ships, facilitating the export of a wide range of bulk commodities, including IRD’s iron ore.

The $250M Panamax capable port stage I project is intended to be primarily financed by development partners Macquarie Capital and to a lesser extent, Eyre Peninsula Cooperative Bulk Handling (EPCBH). The Cape Hardy port precinct is also supported by a $25M Federal Government grant commitment.

Iron Road maintains 100% ownership of the 1100 hectare port site and the CEIP, with the potential to farm-out or divest part of the CEIP project to strategic partners in order to drive both equity and debt financing for the project and facilitation of offtake agreements.

Of note here is the involvement of Cape Hardy Stage I Project Chair and former Premier of South Australia Rob Kerin, who considers the Cape Hardy port project a once-in-a-generation opportunity to provide the key infrastructure that will help the Eyre Peninsula realise that potential.

In addition, along with The Hydrogen Utility (H2U), IRD has plans to develop a large-scale green hydrogen production and export hub at Cape Hardy, extending over an area of 200ha.

IRD’s three key assets are as follows:

According to Argus, the iron ore spot price to North China hit a record US$235.55 a tonne on May 12.

At an exchange rate assumption of US$0.75, an increase in the high-grade 65% Fe commodity price from US$100/dmt to US$120/dmt increases the NPV10 value from US$1.49 billion to US$2.95 billion. If you look at this in the context of the current spot price of circa US$200 per tonne, the metrics look better than compelling – they are mind-blowing set against Iron Road’s market capitalisation of approximately $225 million.

As a guide, the Net Present Value based on IRD’s development strategy is approximately US$1.2 billion based on a price of US$100 per dry metric tonne and an Australian dollar/US dollar exchange rate of US$0.80, slightly above the current spot price of about US$0.78.

The below table shows how the financial metrics look.

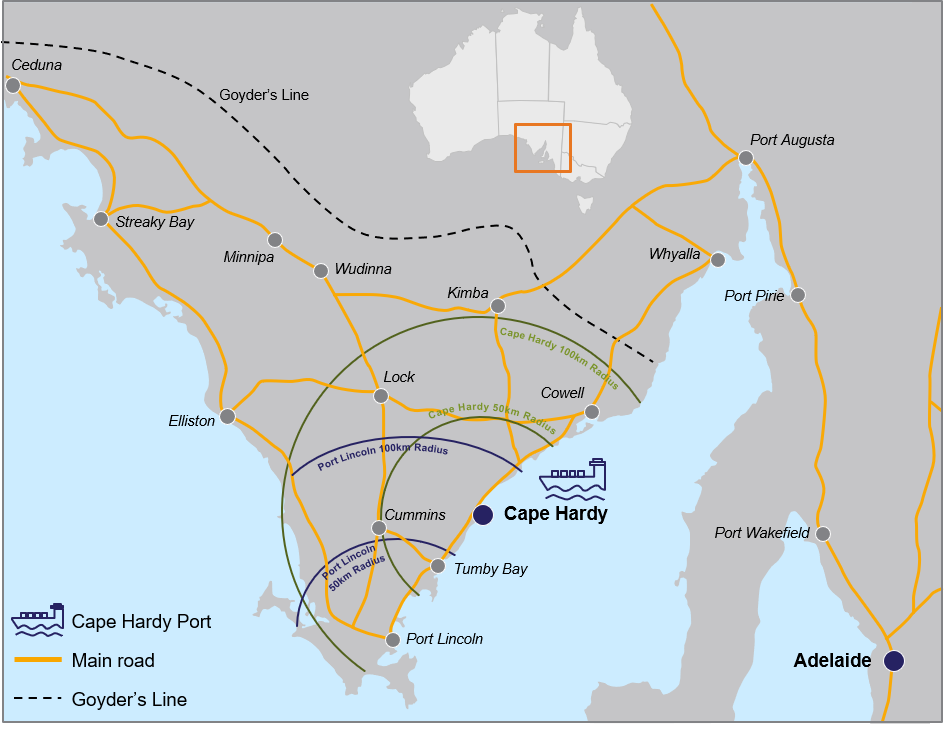

A planned export facility at Cape Hardy is designed to be South Australia’s first Capesize capable port and will be developed over a number of stages.

IRD’s focus over the next 6-12 months includes progressing development of Cape Hardy port precinct infrastructure, attracting investment in the Central Eyre Iron Project (CEIP) and monetising early stage green hydrogen partnerships.

The map below shows the exact location of the proposed port.

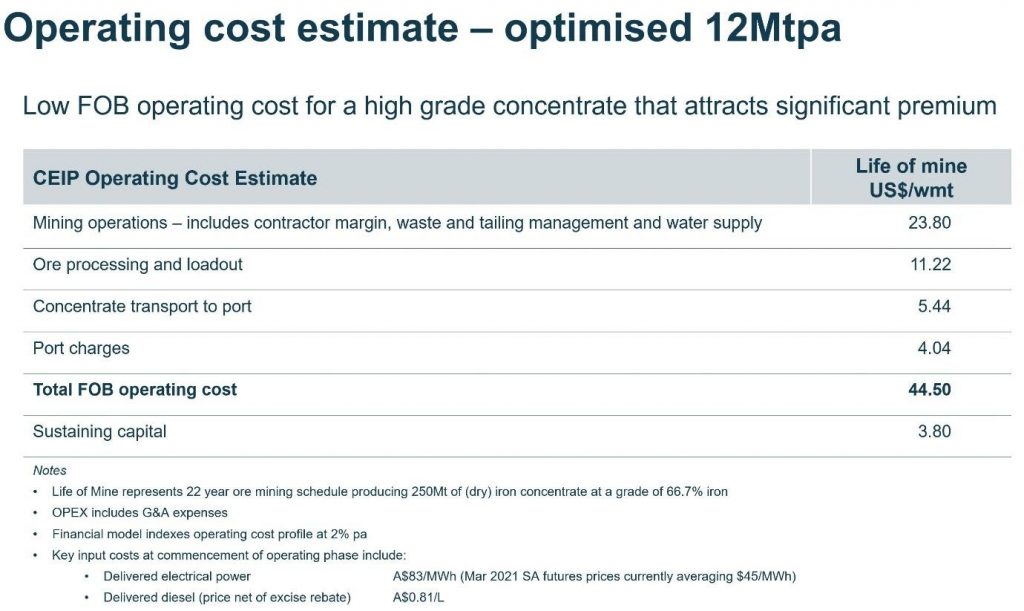

The mine and port are planned to be linked by an infrastructure corridor with an efficient road haulage option (dual-powered road trains) for iron concentrate transport over a distance of approximately 140km. This haulage length is considerably lower than most haulage distances in Western Australia. The corridor includes a powerline and water pipeline over part of its length.

Ore will be sourced for the port from a single open pit mine using conventional truck and shovel methods.

The beneficiation plant located at the mine site is expected to produce a high quality, low impurity iron concentrate that will serve as a clean, superior blending product for steel mill customers.

Although CEIP production options range from 12 to 24 million tonnes per annum (Mtpa), the lighter capital, lower 12Mtpa production model released in February 2019 demonstrates highly competitive operating margins given an FOB operating cost of US$44.50/wmt (Life of Mine) and remains the preferred model to attract CEIP investment.

Infrastructure Australia has identified the potential for the proposed Cape Hardy port to ultimately integrate to the Australian National Rail Network, which would provide the basis for a world class, multi-commodity, multi-user bulk shipment port that can service central and southern regional Australia. It also designates the infrastructure as a Priority Project for the nation.

IRD recently announced a Joint Development Agreement (JDA) with Macquarie Capital (part of Macquarie Group Ltd, ASX:MQG) and Eyre Peninsula Co-operative Bulk Handling (EPCBH), effectively an endorsement of the quality of the group’s asset base and its development potential.

The support from Infrastructure Australia was endorsed by the Federal Government in December 2019 by way of their $25 million grant commitment to assist in financing the development of the Cape Hardy port infrastructure.

The JDA provides the framework to advance development and financing plans for the proposed $250 million Cape Hardy Panamax capable multi-user, multi-commodity port facility.

IRD retains the right to hold up to 25% of the project at Financial Close while maintaining 100% ownership of the 1,100 hectare port site and the Central Eyre Iron Project (CEIP).

IRD owns 100% of the 1,100 ha Cape Hardy port site. Further long-term opportunities for Cape Hardy revolve around its proximity to large-scale renewable energy resources and potential for green hydrogen development.

The South Australian Government has released a prospectus identifying the opportunity for green hydrogen exports to be shipped from a greenfield port in the Cape Hardy region of the Eyre Peninsula.

The prospectus demonstrates how the State can prosper from rising global demand for hydrogen, a commodity that is forecast to contribute as much as $1.7 billion and 2,800 jobs to the national economy by 2030.

The hydrogen export prospectus recognises the ideal location of Cape Hardy on the Eyre Peninsula, connecting renewable resources with an indicative distance to the port of 60 kilometres, and the potential for small-scale and large-scale green hydrogen export ranging from 60,000 to 250,000 tonnes per annum.

On this note, S&P Global Market Intelligence outlined the following on 13 January 2021:

“Mitsubishi Heavy Industries Ltd.’s investment in South Australia’s hydrogen sector has led to plans for an iron ore “green pellet” plant at Iron Road Ltd.’s Cape Hardy port site. It could also pave the way for hydrogen technology to aid Japan’s and South Korea’s steel industry decarbonization ambitions.

“Iron Road told the ASX on Jan. 12 that it recently extended its 2019 heads of agreement and project development accord with Australian renewable energy integrator The Hydrogen Utility, or H2U, by a year.

“H2U has identified that a minimum 200-hectare footprint on the Cape Hardy site is needed for a proposed green manufacturing precinct.

“H2U attracted Mitsubishi Heavy in November 2020 as a partner for its own A$240 million Eyre Peninsula Gateway project at Port Bonython.”

Sitting on the IRD board include two founders of the Sentient Global Resources Funds: Non Executive Chairman Peter Cassidy and Non-Executive Director Ian Hume. The four funds ultimately raised a total of US$2.7BN of capital. Both were responsible for the successful early stage and very high returning investments in Queensland Gas and Andean Resources.

Management is made of up of the following high level figures:

CEO – Larry Ingle

A thirty year industry veteran, Larry cut his teeth with various global companies including Gold Fields of South Africa, Lesotho Highlands Project Contractors (JV), Barrick Gold Corporation and Rio Tinto. He has been with IRD since inception in 2008.

Non Executive Director – Jerry Ellis

Mr Ellis’ career includes three decades at BHP, chairing the company from 1997 to 1999. He also served on the boards of a number of listed companies and governing bodies including Newcrest Mining, Aurora Gold, the International Copper Association, Australia and New Zealand Banking Group, the International Council on Metals and the Environment and the American Mining Congress.

Project Chair – Cape Hardy Port Project (Portalis) – Rob Kerin

Former Premier of South Australia, Rob serves as Project Chair for the Cape Hardy Stage 1 port project. Rob is also Executive Chair of Primary Producers SA, Chairman of Regional Development SA, Director of South Australian National Football League, Deputy Chair Australian Country Football Council, Deputy Chair of Variety (SA) and Board member of Brand SA.

Executive Director, Glen Chipman

Mr Chipman has 20 years of combined industry, mineral economics and equity capital markets experience and also represents the major shareholder having been seconded to IRD since 2013. He has relevant sector and transactional experience having served on the board of Brazilian high quality 4Mtpa iron ore producer Ferrous Resources until it was acquired by industry major Vale in 2019.

Leverage off IRD’s past investment: IRD has spent around $175 million since 2008 to get the company to where it is today, and at its current $150M market cap we feel like we are getting in at a very good valuation at the right time as iron ore starts to run again.

Strong macro theme: We expect IRD will perform very well if the iron ore price strength continues in the global post pandemic construction boom.

Realistic path to market: A port development project for shipping its iron ore is already well progressed since 2008: IRD is in the right place, at the right time with an advanced project.

Institutional Backing: Private equity firm Sentient Global Resources Funds owns 72% of IRD and has been a very long term holder – which means there aren’t many shares available free float on the market. Macquarie Capital is also on IRD’s register as a holder of Warrants.

Co-investing alongside big, cashed up institutions makes us feel confident in the investment over the long term.

Cash in Bank: IRD is debt free and has a healthy cash balance following recent capital raises since December 2020 that brought in $16M. We participated in the most recent placement at 21.5 cents, and so did IRD’s Directors in the SPP on the same pricing terms.

Unknown and undervalued: We like IRD because it’s currently one of the lesser known stocks we have seen on the ASX. IRD appears to have done very little promotion to gain new investors over the last few years, hence offering a good chance of share price upside as they start to roadshow the story.

Net Present Value: IRD’s most recent financial modelling of the iron ore project demonstrated a NPV of US$2.6BN at a high-grade iron ore price (65% Fe) of US$120/t.

‘Green Hydrogen’ generates a lot of attention: Even Twiggy’s Fortescue is looking at it after making billions of dollars in iron ore profits.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.