Overview: MyFiziq Limited (ASX: MYQ) has developed and patented a proprietary dimensioning technology that enables its users to check, track, and assess their dimensions using a smartphone, providing both privacy and accuracy. MyFiziq has multiple enterprise partners that have been attracted to the company because of the technical capability that MYQ’s systems offer its consumers. The partners are able to assess, assist, and communicate outcomes with their clients in the pursuit of better health, an improved understanding of the risks associated with their physical condition, as well as having the monitoring benefits of tracking the changes they are experiencing through training, dieting, or under medical regimes. Partners benefit from the group’s Software-as-a-Service (SAAS) pricing solution: prices reduce with scale. MyFiziq has developed this capability by leveraging the power of Computer Vision, Machine Learning, and patented algorithms to process images on secure, enterprise-level infrastructure, delivering an end-to-end experience that is unrivalled in the industry.

Market moving developments: Partnering agreements are central to MYQ’s operational expansion and revenue growth. The announcement on 5 October that the company had signed a binding term sheet with Nexus-Vita Pte Ltd, a Singapore-based health monitoring and management technology company, was a game changing milestone in MYQ’s evolution and its ability to generate material revenues going forward. Nexus and MyFiziq will collaborate to integrate MyFiziq’s body tracking application into all of Nexus’s verticals, commencing with an initial integration into Nexus’s pre-emptive health platform by January 2021. Under the binding terms sheet, the parties will work together to deliver a market-ready integration into the Nexus platform by the March quarter of 2021.

Nexus has undertaken to deliver a minimum of 100,000 active users within the first 12 months of launch Which has provided MYQ’s shareholders with a significant degree of revenue predictability.

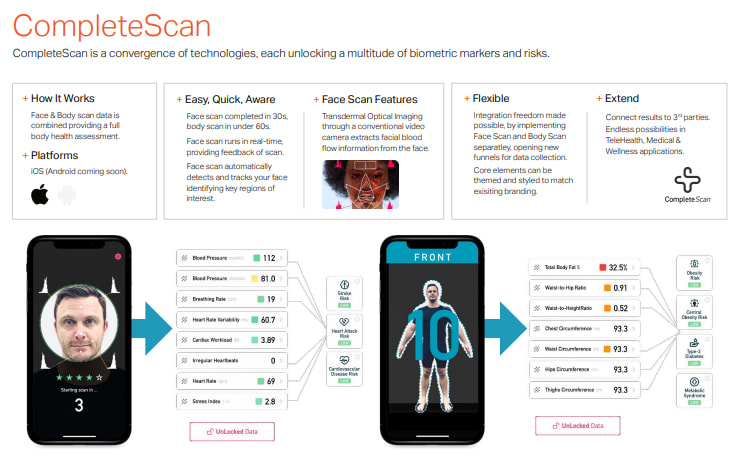

Nexus can significantly improve lifetime health, reduce the need for medical interventions, and save costs and resources for the user and health systems through its partnership with MyFiziq and the use of its CompleteScan technology.

Catalysts: Because there are numerous avenues for expansion as already demonstrated by MYQ, multiple catalysts need to be considered when examining what lies ahead for the company. One only has to examine the company’s share price performance over the last six months to appreciate the comprehensive news flow that sparked a 20-fold share price surge from 6.5 cents in March to $1.31 in September.

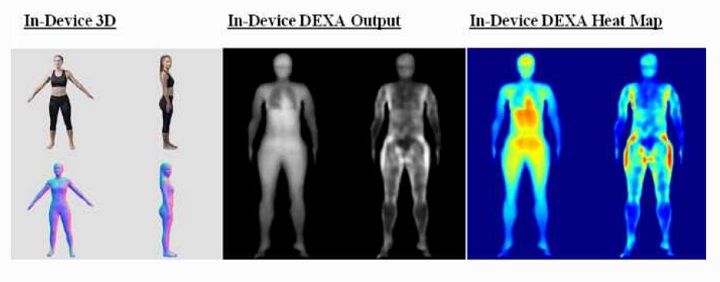

Key drivers over this period have been technology improvements, expansion to new platforms, partnership agreements and the granting of patent protection. MYQ is not only benefiting from direct relationships with multinational players, collaborations such as the one with Bearn that saw the latter’s app made available on the Apple App Store and the Google Play Store has also provided traction. Similarly, as evidence of the operational and financial benefits resulting from the convergence of CompleteScan with MYQ’s own technologies and that of its partners, the company will be increasingly priced relative to its growth profile, a factor that is traditionally used in the tech and biotech field. MYQ’s technological advances have accelerated in recent months, most recently with advances in in-device capabilities where they are now achieving tissue and body fat medical images that are highly correlated with medical scans, effectively opening up lucrative new markets.

Hurdles: While a significant contributing factor to MYQ’s growth has been its ability to stay in front of the field in terms of competing with similar technologies, this is always a risk factor in the tech industry. Partly offsetting potential risk factors associated with the impact of competitive technologies is the group’s ability to forge relationships with complementary technologies, establishing strong industry collaborations that provide access to multiple markets. This has led to the company effectively becoming a device-based health triage consultant by providing insurers, medical professionals, and healthcare providers with vital information as permitted by users. However, one of the key unknowns is the quantum of revenues that can be derived through MYQ’s direct and indirect client base, particularly given the multitude and diversification of its partners. Indeed, this will become one of the important areas of focus in 2021.

Investment View: MYQ isn’t a company at this stage that lends itself to attributing a valuation using conventional metrics. Significant investment has been made in technological development, positioning the company to generate substantial revenues in the coming years. However, it is worth noting that the group generated positive cash flow for the June quarter despite COVIDrelated financial pressures, as well as the challenge of finding a balance between managing capital invested while maintaining balance sheet stability.

MYQ’s cash from operating activities of $93,000 effectively demonstrated that there was zero ‘cash burn’ for the June quarter. Operating cash expenditure in the June quarter showed a significant turnaround. The average operating quarterly cash expenditure for the prior three quarters was nearly $1.2 million compared with the June operating cash expenditure of $586,000, representing a 50% decrease.

As we discussed earlier, MYQ will be increasingly valued in line with its peers in the tech industry that is growing rapidly off a low base and have the ability to deliver exponential growth through upscaling the established business off a relatively fixed cost base while also establishing value accretive partnerships and collaborations.

Investors are already witnessing a market capitalisation based rerating as evidenced by the significant share price increase, and this should continue with additional momentum potentially coming from a dual listing on the NASDAQ.

MYQ’s assets are its technologies, its partnerships and its team of developers with the latter being instrumental in providing management with the range of products to take to market and negotiate valuable collaborative agreements. The company’s products are at various stages of their journey from research to ‘in development’, to design and implementation, to launch and eventual revenue generation.

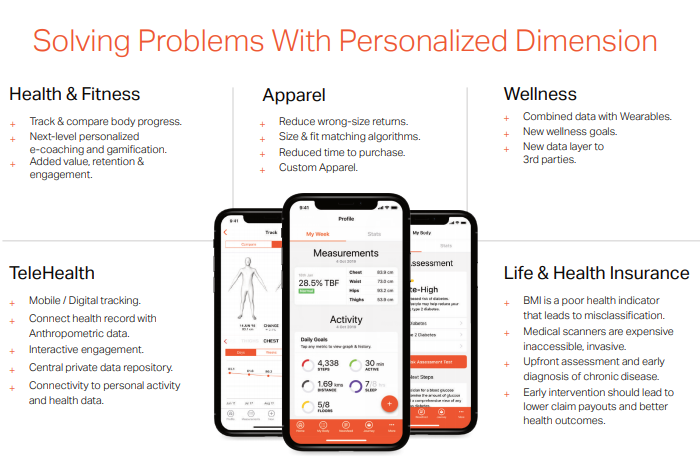

Importantly, as we will go on to demonstrate, there are significant cross-selling opportunities spanning its operations that are leveraged to health and fitness, wellness, apparel, telehealth and life and health insurance.

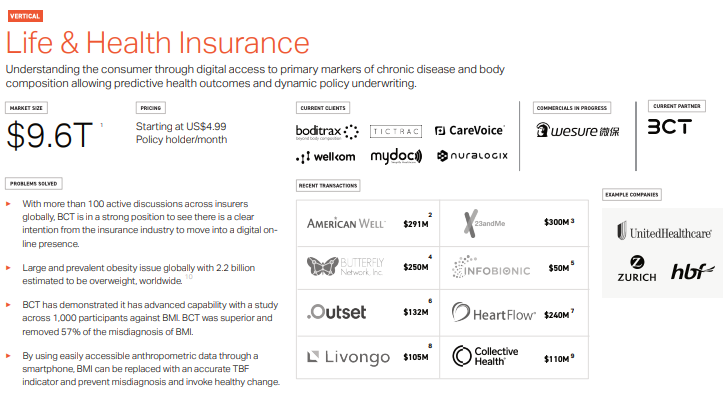

However, setting aside the wide range of technologies for a moment, it is worth noting that there has been intense merger and acquisition activity across the telehealth, health and fitness and life and health insurance industries over the last 12 months. These industries have market sizes of US$559 billion, US$672 billion and US$9.6 trillion respectively.

MYQ owns 54.5% Body Composition Technologies (BCT) registered in Singapore (Pte Ltd) and Australia (Pty Ltd) as the investment vehicles and structure for the joint venture, both internationally and in Australia. BCT is continuing to work with MyFiziq to further develop and commercialise the application for the multi-trillion dollar medical and insurance sectors, allowing an up to date record of the patient’s body shape and body composition to be directly available to the participant and to their medical practitioner’s or insurer’s records.

LIFE AND HEALTH INSURANCE

BCT has deployed its first commercial partner in Hong Kong with The CareVoice. This release is the first BCT platform using the MyFiziq body shape and circumference system and will soon be enhanced with the group’s new total body fat capabilities. The primary goal is for this technology to replace of date Body Mass Index (BMI) as a measure of an individual’s body composition for the medical, health and life insurance sectors.

BCT has advanced its capabilities significantly over the past 3 years, with the addition of risk indication calculations and chronic disease identification, total body fat and the adoption of World Health Organisation and International Diabetes Federation parameters. These measures have been adapted and embedded in the process of evaluation within the platform.

Access to BCT’s technology and these early indicators of risk will offer insurers and healthcare providers a more accurate understanding of how their policyholders are trending with their body weight and composition, which directly correlates to their management and risk of developing chronic health conditions. BCT has continued advancing commercial activities with over 150 Healthcare and insurance providers engaged in commercial discussions, application evaluation and testing.

HEALTH AND FITNESS

MYQ taps into the $670 billion health and fitness industry by enabling consumers in that sector to measure their changes, track progress and tangibly appreciate the transformation.

Value is added through new member subscriptions and on this note, the company’s partners are of the view that adopting MYQ’s technologies will assist in boosting member engagement and retention. Access to biometric data layers will assist in refined coaching and nutrition, resulting in improved chances of achieving fitness goals. MYQ’s technologies essentially unlock primary health markers, allowing partners unprecedented access to meaningful health profiles.

Pricing projections recently released by MYQ commence at US$4.99 per user per month. Current clients include boxing fitness group Mayweather, as well as other prominent health and fitness groups such as Bearn, Evolt and Active8me which has an app that is available in the Appstore and Google Play.

WELLNESS

In the $85 billion wellness sector, MyFiziq helps employers protect and engage their employees through gamification and digital health tracking via multiple partner applications. This results in better employee retention, less sick leave and increased productivity.

Current wellness platforms are competing against each other with the same solution, but they are branded differently. Adding digital anthropometric capabilities with MyFiziq is the ultimate know your customer (KYC) of health. Combining body circumference and composition with wearables allows an added layer of data to drive wellness goals in an unprecedented fashion.

Big data with body measurements provides a new digital trackable metric never available before to users, medical professionals and insurers. Primary markers of chronic disease are unlocked, potentially allowing prevention and earlier intervention, making for a healthier workforce.

Current clients include global transport and logistics group Toll, behavioural change company Biomorphik and Canadian based NuraLogix Corporation, with MYQ having signed a formal reseller agreement with the latter just last month. The pair will grant Nexus the right to use and sell the CompleteScan platform and related intellectual property.

NuraLogix has developed patented technology that features never before available digital health and chronic illness assessment. This utilizes a video camera like that found on a smartphone to take a 30-second selfie video of the user’s face with the capacity to determine a wide range of physiological and health-related parameters such as heart rate, heart rate variability, blood pressure, stress and cardiovascular disease risks.

NuraLogix also developed an AI-based model which was trained and tested on profiles of COVID-19 patients. The model predicts the likelihood of someone having COVID-19 as opposed to seasonal flu or cold. NuraLogix has been published previously for its work in determining health parameters via a mobile device in world-leading publications such as The American Heart Association – Circulation: Cardiovascular Imaging.

Interestingly, doctors and clinicians that collaborated with NuraLogix in concluding the COVID-19 study determined the outcome to be so significant, the results are being presented for publication.

It is worth noting that wellness technologies could be in strong demand in the aftermath of COVID given its indirect implications in terms of mental health and productivity following long periods of isolation. Pricing for wellness products starts at about US$4.99 per employee per month.

TELEHEALTH

Digital technologies are becoming an important resource for remote precision medicine and personalised care. Within the $559 billion telehealth industry, mobile technologies are particularly relevant due to their ease of use, broad reach and wide acceptance. In 2015, there were more than 7 billion mobile telephone subscriptions worldwide, over 70% of which were in low or middle-income countries.

Telehealth has emerged as a powerful weapon in the war against the COVID-19 pandemic. People are actively adopting teleconsultation and remote monitoring services. The high emphasis on social distancing between the patient and the physicians is one of the major factors for the rising uptake of these services.

Furthermore, the queries of people related to coronavirus infection and the fear of virus transmission while travelling to hospitals have accelerated, effectively driving demand for online consultations. There have been numerous digital health mergers and acquisitions as this sector has gained traction, with one of the most prominent being the US$18.5 billion takeovers of Livongo by Teladoc. By their very nature, there is a significant crossover of MYQ clients between other sectors and telehealth with notable examples being Nuralogix, Bearn active8me, but another prominent player is mydoc.

APPAREL

While the overlap between MYQ’s technologies and the US$1.4 trillion global fashion retail market is perhaps regarded as insignificant, it is worth noting CNBC’s report which indicates that Amazon has spent more than US$50 million in recent years in buying 3D body scanning start-up body labs. MyFiziq provides the ability to accurately measure a person for both online and instore purchasing of clothing, providing a personal shopping experience.

Importantly, preventable returns due to incorrect sizing cost retailers US$63 billion each year according to independent research. MYQ’s technologies are ideally suited to sizing given that they process factors relating to both dimensions and an individual’s shape. This opens up opportunities for distributors to market customised apparel.

There is already evidence that getting sizing right results in improved customer retention and loyalty. Multinational manufacturers of fashion goods are realising that size is the prize.

Nike acquired Invertex which has released its FeetID system, including an in-store unit that 3D scans a precise measure of a shopper’s feet, sending it directly to their mobile phone within seconds. A cognitive match engine guides the shopper to all the shoes in the store that marry up with the 3D scan, as well as providing personalised information and reviews to enhance the shopping experience.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.