Overview: Euro Manganese Inc’s (ASX: EMN; TSX-V: EMN) principal focus is the development of the Chvaletice Manganese Project (CMP). The company’s plan involves the re-processing of Europe’s largest manganese deposit, hosted in historic mine tailings in the Czech Republic. EMN aims to produce high-purity manganese products (HPM) in an economically, socially, and environmentally- sound manner. It will be recycling waste to produce highly refined manganese metal and salts. The project is surrounded by a large and growing cluster of an electric vehicle, battery, and battery metal plants, most of which are located within hours of driving/rail distance, and most of which consume directly or indirectly HPM. These are the finished products that producers of lithium-ion battery cathodes require. Through its subsidiary Mangan Chvaletice, EMN owns 100% of the rights to the Chvaletice deposit. The company has also assembled an industrial land package located immediately south of the highway and rail line that bounds the Chvaletice tailings deposit, where it plans to build the Chvaletice HPM process plant. This strategic land parcel, which is connected to a major rail line, is adjacent to an 820-megawatt power plant and will be the site of its proposed state-of-the-art HPM processing plant.

Catalysts: There are multiple catalysts that should support the development of CMP and in turn provide ready markets for its HPM products.

The significant environmental benefits that accompany the development of CMP are at the forefront of the company’s compelling merits. Not only will CMP be viewed as environmentally beneficial in terms of recycling waste, but the primary market for the end product is electric vehicles, arguably the most prominent generational green theme with regard to mass-market distribution.

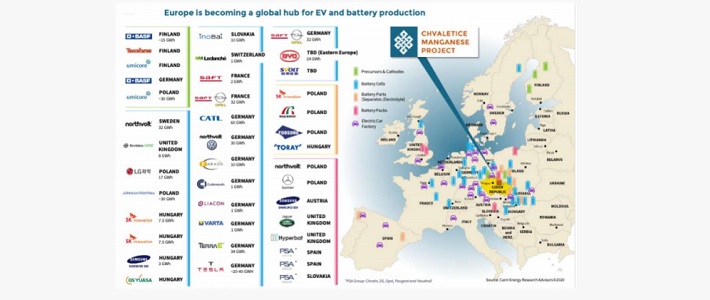

CMP’s location is ideal given its proximity to major European motor vehicle manufacturers, and the burgeoning battery manufacturing industry.

EMN noted that 30 battery and battery precursor and cathode factories, with no fewer than 25 electric car factories are already operating, under construction, or have been announced in Europe recently. Recent data indicated that nine of the top 10 countries surveyed for electric vehicle penetration were located in mainland Europe.

Further to this, Tesla is building a Gigafactory in Germany and recently announced it will be using 33% high purity manganese in its new EV batteries.

2021 could also provide several catalysts including:

Hurdles: In the near term, there are likely to be COVID-related disruptions and delays in the electric vehicle sector. While environmental studies, planning, and project permitting procedures are at an advanced stage, these boxes need to be ticked in the lead-up to construction. EMN has completed all planning and design for the construction and commissioning of a demonstration plant (DP) in the Czech Republic in order to provide bulk, multi-tonne finished product samples for customer evaluation and supply-chain qualification. While the company successfully built and operated a pilot plant that confirmed it can achieve the highest quality and specifications that will be required by customers, the production of a commercial scale HPM that meets the needs of manufacturers are yet to be proven, and this will, in turn, provide the platform for the company to negotiate offtake agreements that will be crucial in terms of gaining project financing.

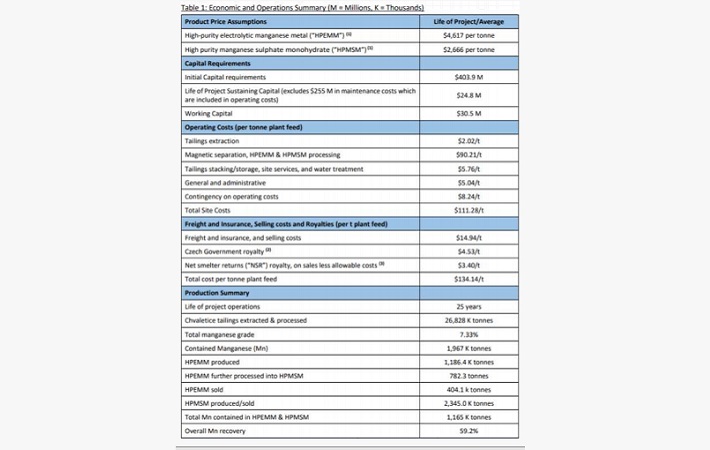

Investment View: A Preliminary Economic Assessment (PEA) of CMP reflects some compelling metrics in terms of the net present value of the project, its mine life, internal rate of return, and payback period. Over a 25-year mine life, the PEA estimates that the project can deliver after-tax undiscounted cumulative cash flow of nearly $3.3 billion. Based on these metrics the project is valued at $593.2 million on an after-tax basis with an implied discount of 10%. While the initial capital requirements of $404 million are substantial for a smaller company, EMN has already been granted investment incentives from the Czech government, in the form of tax credits, and one would expect that some of the heavy hitters in the battery and motor vehicle manufacturing industries may see significant supply and pricing benefits in taking a financial stake in the project. On this note, EMN has already signed five memorandums of understanding to conduct product supply chain qualifications that are intended to form the basis for long-term offtake agreements.

Through its subsidiary Mangan Chvaletice, EMN owns 100% of the rights to the Chvaletice deposit and has entered into an option agreement to acquire several parcels of industrial land located immediately south of the highway and rail line that bound the Chvaletice tailings deposit.

The Czech Republic is a stable, modern democracy with a free-market economy and a favourable investment, fiscal and legal regime. Human and property rights are valued and respected. While it is a member of the European Union, the country preserves its monetary independence, boasting one of Europe’s highest levels of economic growth.

THE RESOURCE

The company’s plan involves the re-processing of Europe’s largest manganese deposit, which is hosted in historic mine tailings in the Czech Republic, with the aim being to produce high-purity manganese products (HPM) in an economically, socially, and environmentally-sound manner. It will be recycling waste to produce highly refined manganese metal and salts.

The manganese in the Chvaletice tailings deposit principally occurs as manganese carbonate minerals, unlike the vast majority of manganese deposits in the world, which are made up of manganese oxides. Manganese oxides are refractory to acid leaching and require roasting or chemical reduction pre-processing in order to become soluble and amenable to processing into high-purity manganese products. This can create substantial environmental challenges, while manganese carbonates are readily leachable, without prior processing.

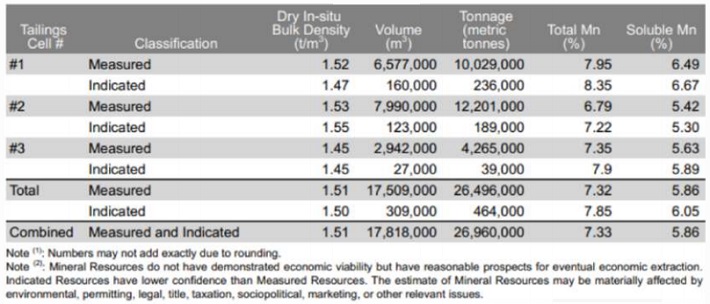

In 2019, EMN filed a Technical Report prepared by Tetra Tech Canada Inc., which reported an updated Mineral Resource Estimate and the results of a Preliminary Economic Assessment (PEA) for the Chvaletice Manganese Project. This found that 98.3% of the resource is now classified as Measured under JORC and NI 43:101 codes.

THE STRATEGY

Having 98.3% in the measured category is exceptionally high for the mining industry and attests to the homogeneity of the deposit and to the attention to detail that has gone into the evaluation and planning of this project.

The CMP is targeting the production of ultra-high-purity electrolytic manganese metal (HPEMM) with specifications exceeding 99.9% manganese and ultra-high-purity manganese sulphate monohydrate (HPMSM) with a minimum manganese content of 32.34%, both of which exceed typical industry standards.

The CMP production process will be selenium, fluorine, and chromium-free, and its products are designed to contain very low levels of deleterious impurities.

EMN’s focus on producing very high purity products is another key differentiator. The purity of raw materials is critically important in the new generation of lithium-ion batteries. It greatly influences battery performance and safety.

The company has demonstrated the suitability of the Chvaletice tailings for the production of very high-quality HPEMM and HPMSM in extensive bench and pilot-scale metallurgical tests, during an intensive two-year process design program.

The technology used in the CMP process is commercially-proven and is being adapted through innovative approaches to meet or exceed demanding customer and European Union environmental standards.

The CMP process entails concentrating the manganese in the tailings using simple, clean, and low-cost magnetic separation, followed by the dissolution of the manganese and production of highly refined manganese metal, using electrolysis, which can then be converted into high-purity manganese sulphate powder. The plant is designed to be flexible and to deliver HPEMM to some customers and HPMSM to others.

High grade, high purity manganese is used as a primary cathode material in lithium-ion nickel-manganese-cobalt batteries or NCM batteries, and research has indicated that it increases performance and recharging capabilities.

High-performance NMC Li-ion batteries are being increasingly used in electric vehicles and other energy storage applications.

The manufacturing processes and formulations for Li-ion batteries require reliable, high-purity sources of manganese and other battery raw materials to ensure that the batteries meet increasingly demanding performance, safety, and durability standards.

The high-purity manganese materials for the precursor cathode materials of NMC batteries can be supplied in the form of CMP’s HPEMM and HPMSM products.

With demand for high purity manganese growing rapidly due to the burgeoning electric vehicle and Li-ion battery industries, there is little doubt that the demand side of the equation will remain robust for many years.

Demand will also be supported by government initiatives. The increased focus on the renewable energy industry was recently highlighted when the European Union unveiled a €750 billion ($A1.2 trillion) plan for a climate-led economic recovery from COVID-19 that prioritises investment in renewable energy, clean transport, smart energy, and emissions reduction.

Tesla is one of a number of big names flocking to Europe with a planned Gigafactory in Germany which will be situated near Berlin.

Europe is expected to become the second most important centre (after China) of the global electric car and battery industries.

At least six large battery factories that will consume manganese inputs are located between 200 kilometres and 500 kilometres of the Chvaletice Manganese Project. Others are being built across Europe.

Several prospective customers have expressed interest in procuring high-purity manganese products from the Chvaletice Manganese Project, and in conducting supply-chain qualification of the products of the proposed Chvaletice demonstration plant.

Euro Manganese has already signed five memorandums of understanding with major customers, which are intended to evolve into long-term offtake agreements.

EMN has reported that these customers are attracted by the strategic European position of Chvaletice, the incomparable environmental footprint of the project (no mining or new solid waste generation), and the exceptional purity of the products that Euro Manganese has produced in previous pilot plant trials.

These parties have included manufacturers of electric vehicle batteries and related chemicals who aim to design precursor and cathode formulations, in combination with available nickel, cobalt, and lithium products, as well as chemical, aluminum, and steel companies that require ultra-high-purity manganese products for high-technology applications.

EMN sees the Chvaletice Manganese Project is becoming an important and environmentally sustainable part of the international and European lithium-ion battery supply chain.

Management expects that EMN will become the only primary producer of high-purity manganese in the European Union, where 100% of manganese requirements are currently imported. EMN sits on the largest manganese resource in Europe.

This is significant as Tesla plans to use 33% high purity manganese to power its next generation of electric vehicles. Tesla CEO Elon Musk said he was seeking high purity manganese as a primary raw material for battery manufacture. Tesla’s new EV batteries will contain 1/3 manganese, 2/3 nickel, and no cobalt. Production is to begin immediately.

Given the large scale of the project, one would normally expect long development times for EMN.

However, EMN has completed five years of work on CMP and, in late June 2020, filed an environmental impact assessment notification with the Czech Ministry of Environment, triggering the project permitting process.

It has initiated a definitive feasibility study and expects construction of the full-scale facility would take between 18 months and 24 months. The company is targeting commercial production by late 2023 or early 2024.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.