ASX:FYI investment added to Wise-Owl Portfolio

After months of due diligence, research and multiple calls with management, we have decided to make a long term investment in FYI Resources (ASX: FYI) in the Wise Owl Portfolio.

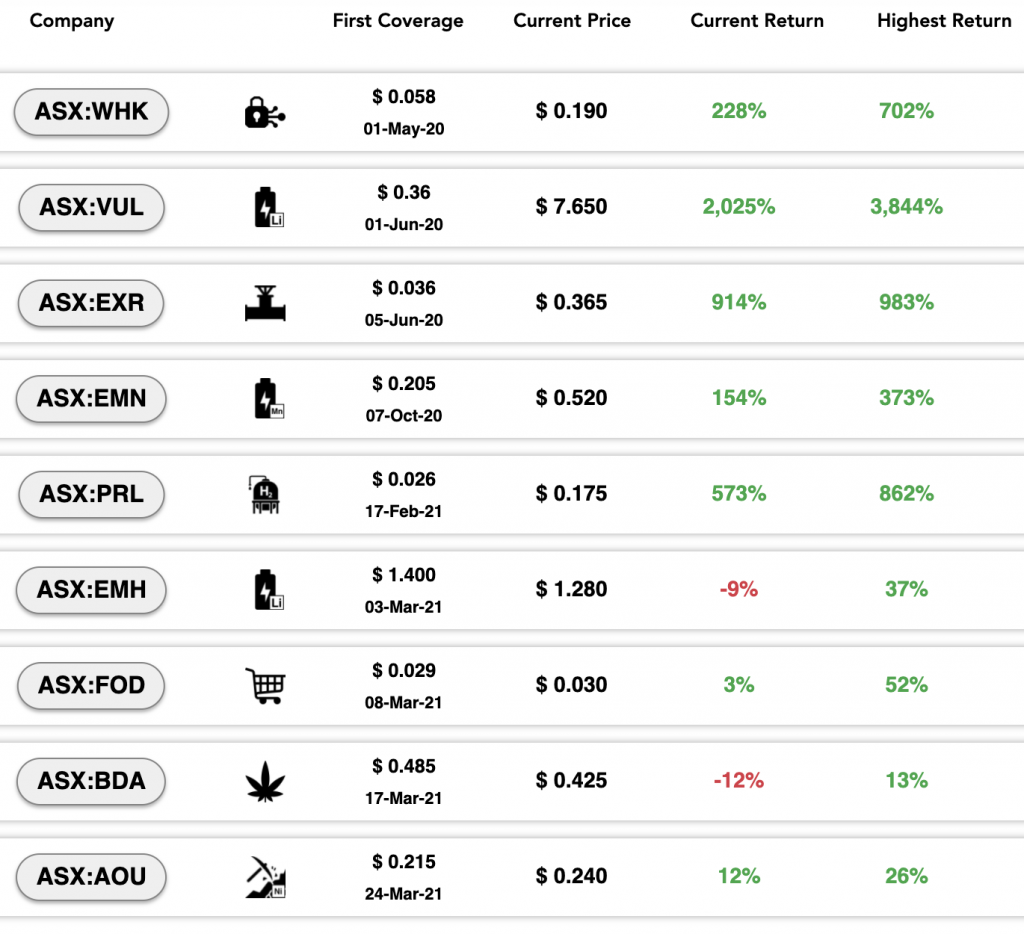

Our new model (introduced in May 2020) is to make around ten long term investments per year in carefully selected ASX companies and share our analysis on why we are invested.

We always do extensive research and due diligence before we make a new investment, and in our experience holding long term for the company to deliver on its business plan has given us the best returns.

We send updates on all our investments as they evolve over time, and whenever we make a new investment.

Over the last 12 months we have made nine investments in our portfolio.

Today we are pleased to announce our tenth long term investment:

FYI Resources (ASX: FYI) is in the advanced stages of bringing a High Purity Alumina plant into production.

High Purity Alumina (or HPA) is increasingly used in Electric Vehicle (EV) batteries. Some forecasts have the demand for HPA to rocket from the current 40,000 tpa to over 140,000 tpa by 2026.

FYI is capped $160M – and recently updated a Definitive Feasibility Study which demonstrated a Net Present Value of over A$1.3BN.

Just six days ago FYI entered into exclusive JV negotiations with Alcoa – one of the world’s leading alumina producers – the outcomes of this in less than 90 days will give investors much greater clarity on financing options for FYI.

We are hoping that FYI’s market cap will start to grow from here as clarity on financing options becomes clear.

We have prepared a research report of why we invested in FYI which we look forward to releasing in the coming days.

In the meantime here are the four key reasons we made an investment into FYI.

1. FYI is leveraged to the “Battery Metals” thematic – and we have done well in this space before

We think as the world switches from petrol guzzling cars to electric vehicles, there are vast opportunities for wealth accumulation.

We have been researching more and more about what goes into batteries and what materials might face supply shortages over the coming years.

High Purity Alumina (HPA) is one of them – HPA is increasingly used as anode/cathode separators in lithium-ion batteries, replacing commonly used polymers. This is because HPA can handle the higher temperatures in higher capacity batteries.

Prior to investing in FYI, we did not have any exposure in our portfolio to this material and its global demand.

2. FYI’s development project is at an advanced stage, with strong economics – it looks financially robust

We like that FYI’s project is at an advanced stage of development.

It means we can get a better look at the economics of the project, and it means that production is much closer (compared to other earlier stage exploration stocks that are trying to establish a resource).

FYI has a large kaolin clay resource (JORC proven and probable ore reserve) that supports a 25 year mine life.

In simple terms FYI will mine this resource, and then truck it to FYI’s processing plant, where it will be converted into High Purity Alumina (more on the process below).

FYI released an updated Definitive Feasibility Study recently, which highlighted the financial robustness of the project. The Study presented the following key metrics:

- Proposed production rate of 10,000 tonnes per annum of HPA

- Expected production cost of < US$7,000 per tonne

- After tax Net Present Value (NPV) of A$1.352BN

- Internal Rate of Return (IRR) of 55%

- Peak annual EBITDA of A$250M

- Upfront capital cost of $A$270M.

The next steps for FYI are to get financing sorted for the upfront capital cost – and the company is pursuing a few options here. FYI has:

- An $80M equity facility in place with a $3.4BN alternative investment fund, and;

- Alcoa Exclusive JV in place with negotiations happening now.

3. FYI is in exclusive talks with Alcoa on a potential JV

Alcoa is a Fortune 500 company, and one of the world’s leading alumina producers, with a global reach and relationships.

Alcoa operates an alumina refinery in Kwinana – in the same area as FYI’s HPA processing plant.

Alcoa is extremely interested in what FYI is doing, to the point that both parties recently entered into a 90 day exclusivity agreement to facilitate detailed negotiations for terms of a possible joint venture on FYI’s HPA project.

Any commercial deal between FYI and Alcoa should provide a clear path for the development of the project, funding, operation and product marketing.

We are extremely curious to see how this deal might progress, and look forward to the end of the 90 day period to know more – securing a deep pocketed partner to bring the project to production would be a huge milestone for FYI.

4. FYI’s has a better process for HPA production – cheaper and less carbon emissions

When researching this stock we were surprised to learn how capital intensive and carbon emitting the traditional process of HPA production is, with little evolution since the 1880s.

HPA is traditionally derived from aluminum via bauxite, producing an end product of variable end product quality and high levels of impurities.

FYI gets its HPA from kaolin clay – environmentally this is much lower impact. The process is simple, resulting in cheaper capital and operating costs.

FYI’s process reduces raw material waste and generates low toxic waste, with extensive recycling at the inputs and outputs.

FYI has calculated approximately 50% reduction in greenhouse gas emissions and 40% reduction in processing energy consumption per ton of HPA.

High ESG standards have become a prerequisite for HPA offtake customers – FYI has best practise here, including traceability of its process.

Following FYI’s Pilot Plant work, the company has demonstrated it can deliver a dependable supply of HPA for long term contract buyers, with high ESG standards – putting it in good standing to attract Tier 1 customers.

Upcoming FYI Catalysts to Look out for:

- Confirmation of a formal joint venture commercial agreement with Alcoa,

- News of any customer offtake agreements – multiple rounds of meetings have already been conducted, trial products sent to potential customers,

- Upward revisions in global demand projections for HPA,

- Updates on the balance of project funding, and;

- Final Engineering & Investment Decision (FID).

We think FYI is well positioned to bring its HPA plant into a reality over the coming years, after demonstrating all the project’s credentials over recent months.

The next stage is financing and to that end, the Alcoa negotiations are a strong positive sign.

Given the surge in HPA demand driven by its use in lithium ion batteries, we are hoping that FYI can capitalise on this over the coming years.

We look forward to bringing you more coverage on FYI over the coming months, starting with a detailed Research Report that we will release in the coming days.