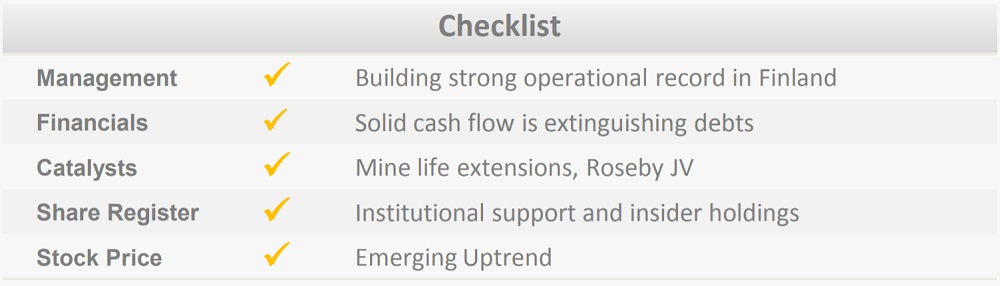

Overview: Altona Mining Limited (“AOH”, the Company”) is an Australian minerals Company focused on copper. Its most advanced asset is the Outokumpu Project in SE Finland, which hosts a polymetallic ore reserve of 4.2MTand a 0.7MTpa processing plant. Altona commenced metal production at Outokumpu in 2012. At an earlier stage of development is the Company’s Roseby Copper Project near Mt Isa in Queensland, Australia. A Bankable Feasibility Study completed in May 2012 delineated copper-gold reserves of 53MT.

![]()

Catalysts: Altona generated its maiden profit in FY13 as Outokumpu became operational. With borrowings cut in half to US$10 m during the last quarter, and management upgrading production guidance, the Company’s transition to a ‘self-funding’ status is expected to drive interest. Securing mine life extensions at Outokumpu and a development partner for Roseby are major value catalysts. The Kylylahti orebody at Outokumpu remains open at depth, with recent extension drilling returning its best-ever intercept, 108 metres at 2.4% copper and 1g/t gold. At Roseby, discussions have commenced with China-based development partners.

Hurdles: Roseby’s commercial potential became uncertain following Xstrata’s withdrawal from a development partnership in 2013. Cash flow remains subject to metal price fluctuations and there is no guarantee that deeper extensions of the Kylylahti orebody will be economically minable.

Investment View: Altona has a balanced portfolio of development and production assets with leverage to copper prices in low-risk jurisdictions. We are attracted to the Company’s operational record in Finland, strengthening its financial position, and strategic positioning of the Roseby Project. Subsequent to Xstrata’s withdrawal, Chinese investment in the Mt Isa region has increased significantly, including $1billion in construction funding for the adjacent Dugald River Project. Expecting a new partner to drive growth, we commence coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.