Bod Australia Ltd (ASX:BDA, “BDA”, “the Company”) is an Australian medicinal cannabis, Cannabidiol (CBD) and hemp healthcare company that delivers premium, proven and trusted products for both the consumer and medicinal markets.

The Sydney-based company has an established sales network in Australia and the UK, and is rapidly expanding into multiple international markets including the USA, Italy, France and the Netherlands.

Importantly, BDA’s CBD and hemp oil preparation last year received a self-affirmed Generally Recognised as Safe (GRAS) status in accordance with the stringent US Food and Drug Administration (FDA) safety guidelines. This renders its products safe for use in a wide range of food supplement and beverage applications.

BDA’s expansion into global markets comes via its relationship with Health and Happiness Group Ltd (HKSE: 1112).

Health and Happiness Group (H&H) is the owner of Swisse, the Australian leader in the vitamins, herbal and mineral supplements market.

BDA operates under two very distinctive verticals, its Medicinal Cannabis division and its CBD and Hemp Consumer Products division.

There are several investment highlights to digest, when considering BDA as an investment opportunity. These include:

“We want to give people who suffer from chronic and severe conditions that haven’t had luck with conventional treatment options, the chance to try something that could alleviate suffering.” – Jo Patterson CEO BOD Australia

We have invested in BDA as the company provides an early-stage entry to the growing medicinal cannabis market, however unlike most early stage investments, this company is already generating solid revenue.

BDA is a tightly held company: the top 20 shareholders hold ~60% of shares on issue, with CEO Jo Patterson being the third largest shareholder with 7.7%.

Ms Patterson is one of several reasons, Wise Owl has taken its long-term position.

Having started the company from nothing, Ms Patterson’s high level motivation and “skin in the game” has had a material impact on BDA’s growth.

Here is why we invested in BDA:

BDA operates under two very distinctive verticals:

BDA currently has two products in the medical market with others in development. On the consumer side, it has around 35 products.

MediCabilis™

The predominant cannabinoid in BDA’s prescription issued medicinal cannabis product, MediCabilis™, is Cannabidiol (CBD).

MediCabilis™ 5% CBD ECs315 also contains terpenes, which are the naturally occurring compounds found in many plants that give plants their flavour, odour and protect them against microbes. Terpenes also have therapeutic properties.

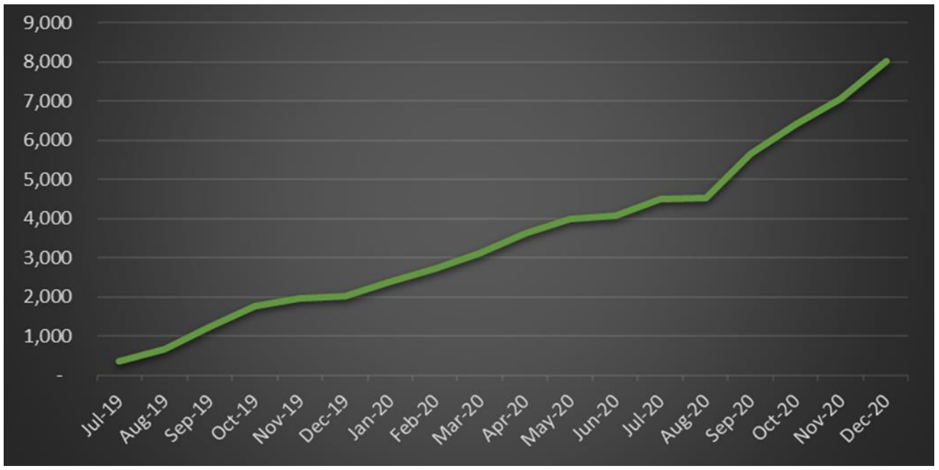

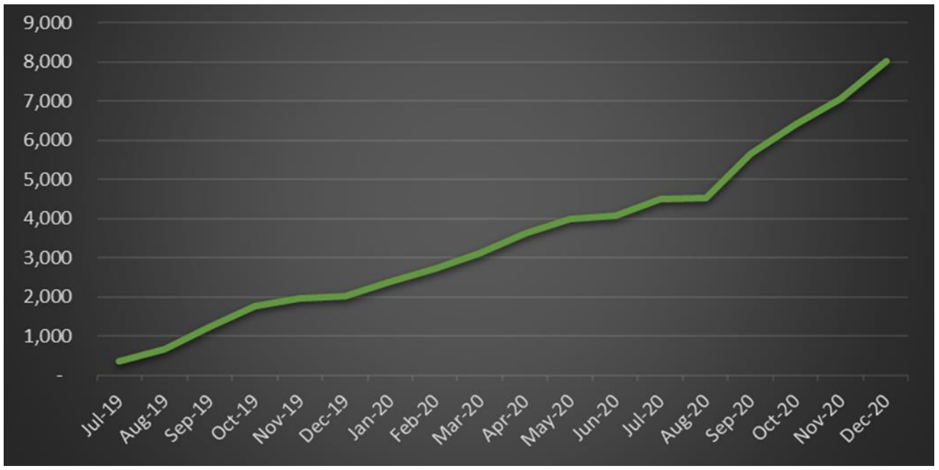

Since July 2019, BDA has filled over 8,000 MediCabilis™ prescriptions.

Of these, a total of 3,941 prescriptions were filled in the second half of the 2020 calendar year, a gain of 114% as compared to 2H CY2019 and up 91% on 1H CY2020.

Contributing to the products impressive sales growth, is the fact that 60% of purchases come from repeat patients.

This high rate of repeat prescriptions highlights growing physician awareness, as well as patient and physician product satisfaction.

Also pointing to continued solid demand is that 74% of prescriptions are being used to treat long term and chronic conditions, such as epilepsy, insomnia, anxiety and chronic pain. These factors have also resulted in BDA gaining a high market share.

In July 2019, BDA entered a transformational exclusive licencing agreement as exclusive CBD partner to Hong Kong-listed Health & Happiness Group Ltd (HKSE: 1112), the parent company of Swisse Vitamins.

Swisse is the Australian leader in the vitamins, herbal and mineral supplements market.

Under the agreement, BDA will receive a royalty on net product sales as well as a cost-plus margin for the supply of its CBD extract and formulas.

This was a significant win for the Company given the strong brand recognition of H&H’s Swisse brand, not to mention its established distribution channels and access to key markets.

The US market, for example, presents a large opportunity for BDA and it intends to capitalise on this, working with H&H Group on its market entry strategy. The upcoming US entry follows the Company’s recent international expansion initiatives in the UK, Italy, France and the Netherlands.

As testament to the partnership, in May 2020, BDA received a binding purchase order from Health & Happiness Group (H&H) valued at $1.43 million.

The majority of the record order is for BDA’s premium CBD products, sold directly to the UK consumers under the CBII brand and includes soft gel cap products and CBD oil products.

BDA and H&H are progressing a number of initiatives to leverage H&H’s established sales channels, distribution footprint and leading brand reputation.

The parties have established sales channels into five major markets, including the UK, Australia, Italy, France and the Netherlands, which are expected to continue to grow considerably in the coming months.

BDA last year partnered with H&H’s vitamin and skincare giant Swisse Wellness to launch hemp-based products for the Australian market.

The pair has successfully launched multiple hemp seed products under the Swisse brand in over 2,000 outlets which have been well received by consumers.

The products include various skincare items and soft gel caps containing hemp seed oil and stocked retailers including Chemist Warehouse, Coles, and Priceline Pharmacy. New products launches are planned to support the range with products earmarked for new markets.

CBII is H&H’s premium CBD focused brand launched in the UK in December 2019, and was the company’s first use of BDA’s CBD in its product range.

This range is directly underpinning sales growth through an innovative direct to consumer model.

The products include CBD oils in various strengths, topical creams, soft gel caps and a range of skincare products. (www.cbii-cbd.com)

BDA’s recent financial performance has been extremely solid when viewed in contrast to its current market capitalisation.

For the half year ended 31 December 2020, total revenue was $3.31M, a 62% increase on the previous first half (H1 FY2020: 2,040,345).

Ordinary losses from activities dropped by 8.4% to $1.29M, as marketing and corporate overheads fell, despite the appointment of new employees in Australia, the UK and the US.

Growth was underpinned by the sale of CBD and hemp products to exclusive global partner and Swisse Wellness parent company, Health and Happiness Group Ltd. Sales to H&H attributed $1.45M to revenue.

This marked a 1,040% increase on a year earlier and highlights the strong consumer demand for BDA and H&H’s innovative CBD and hemp product ranges in Australia, the European Union and the UK.

The Company generated strong revenue from the sale of medicinal cannabis products. MediCabilis™ sales brought in $679,894 in revenue, up 85% on the prior first half, demonstrating the strong appeal and brand recognition that BDA continues to achieve in the Australian market.

Sales of BDA’s legacy health and beauty products declined to $415,122, representing BDA’s continued focus on its high growth business segments of medicinal cannabis and CBD products.

Focus on BDA’s two core divisions led to a 36% decrease in marketing expenditure for the period. Gross profit on sales of goods rose from 22.1% during the PCP to 38.7%, due to volume increases and favourable negotiations with raw material suppliers.

BDA is well funded with ~$10.6M cash at bank and no debt at 31 December. This provides the financial flexibility to fund ongoing CBD and hemp commercialisation initiatives, progress opportunities in key target markets, launch new products, and promote medicinal cannabis prescription growth. A Placement to sophisticated investors in December 2020 raised $8 million (before costs) through the issue of approximately 14.5 million new fully paid ordinary shares at $0.55 per share.

Based on current sales and financial performance, the Company anticipates it will be cash flow positive by the end of 2021.

The company has outlined a number of anticipated revenue drivers, as follows:

With a 57% market share, BDA now has the largest market share in the Australian addressable market defined by full plant, high CBD products.

This is a major achievement in a highly competitive and fast-growing market.

Contributing to BDA’s high market share, is the high rate of repeat patients and prescriptions, patient and physician product satisfaction, and the products being used to treat long term and chronic conditions.

Regulatory shifts in Australia are providing BDA with a larger domestic market and a number of opportunities both locally and in international markets.

On 1 February 2020, it became legal to purchase products containing low-dose CBD over the counter in Australia, after the Therapeutic Goods Administration (TGA) down-scheduled the substance from a Schedule 4 (prescription medicine) to a Schedule 3 (pharmacist-only medicine).

The ruling means that a pharmacist can now supply TGA-approved CBD products, containing a maximum of up to 150mg/day to consumers over the counter, without a prescription.

This is a landmark ruling and unlocks a considerably large market for the Company. BDA expects the shift to underpin strong uptake of CBD products in Australia and is exploring registration steps to introduce a Schedule 3 CBD product.

In BDA’s second established market, the UK, prescription growth is expected to continue pending new partnerships, and participation in Project Twenty21.

BDA is one of five companies and the only Australian company participating in Project Twenty21, the largest medicinal cannabis trial in the EU aiming to target 20,000 patients.

In September 2020, BDA secured a strategic agreement with LYPHE GROUP to streamline UK medicinal cannabis prescription volumes.

LYPHE, which has a growing network of clinics and physicians prescribing medicinal cannabis across the UK, was engaged as BDA’s preferred dispenser for Project Twenty21 to provide patients with seamless and efficient access to BDA’s MediCabilis™ products. This comes as the UK market continues to grow at an accelerating rate, with a significant shift in patients using medicinal cannabis to treat a range of debilitating conditions.

In a move that will provide major support for the cannabis industry, the US House of Representatives passed the Marijuana Opportunity Reinvestment and Expungement (MORE) Act in December 2020 to decriminalise cannabis.

The historic bill aims to remove cannabis from the US Controlled Substances Act and erase non-violent federal marijuana convictions. The bill also recognises the medicinal properties and therapeutic benefits of cannabis.

As the US is a key strategic market for BDA, the Company expects the legislation to have a favourable impact on its business.

BDA and exclusive global partner H&H are currently progressing a number of opportunities in the US, including the launch of BDA’s premium CBII products.

As noted earlier, BDA’s CBD and hemp oil preparation last year received a self-affirmed Generally Recognised as Safe (GRAS) registration concluding it safe for use in specified food products in accordance with the stringent FDA safety guidelines.

This is a major achievement in the introduction of BDA’s CBD and hemp range into the USA and means the proprietary (patent pending) extract is considered safe for use in a wide range of food supplement and beverage applications.

BDA and H&H will launch products directly to consumers through ecommerce platforms as well as with recognised retailers. H&H has an established presence in the USA and BDA expects to generate significant revenue from sales of its products in this market.

Having also entered the Italian market in 2020, in the half year to 31 December, BDA received two binding purchase orders valued at $1 million and $871,413 from H&H for four Swisse hemp seed oil products for the Italian market.

The products are in soft gel cap form and designed to target specific need states including sleep, energy levels, stress and general wellness.

BDA and H&H will launch the products in over 4,000 pharmacies across Italy and through Swisse’s established ecommerce channels.

The launch will coincide with a Swisse branded marketing campaign and sales initiatives, as well as in store promotions and social media campaigns utilising high profile influencers, designed to increase brand awareness. BDA will receive a royalty from product sales from H&H, as well as a cost-plus margin for the supply of its CBD extract and formulas. Production of the range is currently underway, with delivery expected to occur during the current half.

Also broadening BDA’s European footprint, was the Company’s entry into the French market. An additional binding purchase order from H&H valued at $200,000 for Swisse hemp seed oil products designed to target specific need status including stress, sleep, energy levels and general wellness will see products sold in France, as well as existing Netherlands and UK channels.

In October 2020, BDA launched four new CBD products in the Netherlands, under the Swisse Wellness brand.

While BDA has been stagnant with regards to shareholder returns since the start of 2021, we viewed this as an opportune time for our investment.

BDA’s strong financial performance in H1 2021 is a highlight and gives the company a strong position for growth over the rest of the year.

BDA’s exclusive relationship with H&H, will not only continue to contribute to increasing revenues, it should provide several near-term catalysts for investors.

This includes international expansion, where favourable regulatory environments exist and a roll out of products into the US, where legislation surrounding the use of CBD products is beginning to relax.

First sales in the giant US market would present several major catalysts for the Company.

International expansion is being favoured by legislative change all over the globe.

Significantly, in a ruling that BDA expects to have a very favourable impact on its global business, the United Nations Commission on Narcotic Drugs (CND) has accepted a World Health Organization (WHO) recommendation to remove cannabis and its derivatives from Schedule IV of the 1961 Single Convention of Narcotic Drugs.

BDA is well funded, with over $10.6M cash in the bank at 31 December and is projecting it will be cash flow positive by the end of 2021. This is expected to be a future share price catalyst.

BDA is a tightly held stock, led by founder and CEO Jo Patterson, who maintains a significant ownership.

We form the view that BDA has significant upside over the coming months, and are long term investors.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.