European Metals Holdings Ltd (ASX:EMH; AIM:EMH; NASDAQ:ERPNF) is developing the largest hard rock lithium resource in the European Union.

EMH’s project is at an advanced stage of development, and the company is racing to become the first local EU battery grade lithium producer to deliver to an emerging local industry.

The EU is rapidly switching from petrol transport to Electric Vehicles (EVs), as part of the “European Green Deal” which should make Europe carbon neutral by 2050. €750BN has been allocated to generous EV subsidies, alongside penalties for CO2 emissions.

This transition in energy consumption and use has become a key driver of the need for a local source of lithium.

The EU currently has no local supply and requires imports from China and South America, so there is clearly a significantly sized lithium industry about to emerge in the EU, with EMH well placed to capture a significant portion of this market share.

The EU is aiming for 80% local lithium production by 2025, and beyond that, complete self-sufficiency.

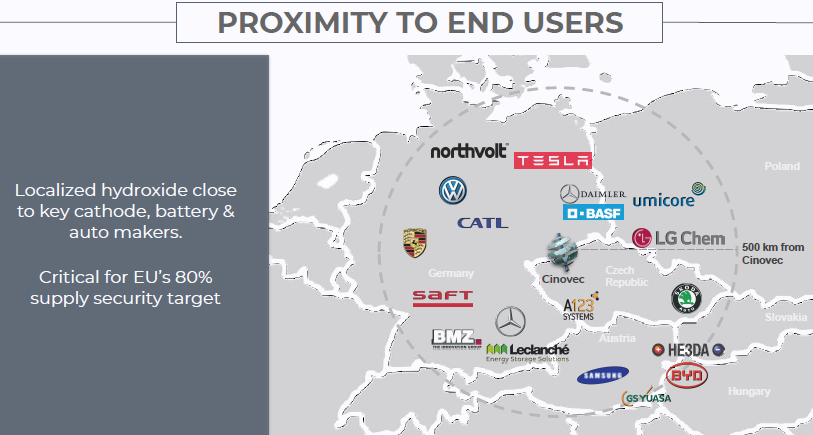

EMH’s Cinovec project is located in the northern Czech Republic, in the epicentre of over a dozen new and planned lithium-ion battery factories, on the doorstep of dozens of potential customers.

As indicated above, high profile end-users such as Tesla, Samsung and Volkswagen are already on the move, and they are at various stages of increasing/adapting capacity to cater for an uptick in demand for electric vehicles and the broader power storage sector – note Cinovec’s central proximity to its potential clients.

EMH is sharing the project with a majority government owned local partner, CEZ, and is arguably the most advanced near term lithium producer in the EU.

EMH has 49% stake in the project company, while CEZ has 51%. CEZ is a large multi-national operating across Europe with a balance sheet of €28 billion, and a clear strategic need to ensure EMH’s project moves into production. The shared project company currently holds €26.7M in cash.

EMH is currently capped at $227M. Following a recent A$7.1M placement at $1.10 per share, the company is fully funded through to a Final Investment Decision in 2022. The placement received substantial participation by a Luxembourg green energy fund, Thematica Future Mobility, indicating the interest in the EU to see project’s like EMH’s into production.

EMH intends to supply a minimum of 25,267 tpa of lithium hydroxide or 22,500 tpa of lithium carbonate over the long term.

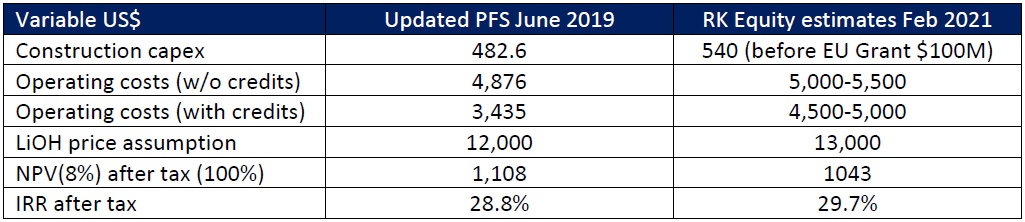

An independent Pre Feasibility Study (PFS) on the project was updated in June 2019, which indicated a post tax Net Present Value (NPV) return of nearly US$1.2 billion, and an Internal Rate of Return (IRR) of 28.8% for the project.

The PFS was based on an assumed battery grade lithium hydroxide price of $12,000/tonne. EMH’s production will sit in the bottom half of the cost curve.

A near term share price catalyst that could provide a re-rate would be news of any offtake deals.

EMH has publicly stated the company is in active discussions with leading global industrials in both the battery and auto industries.

Given the timing of EMH’s planned production coming online is drawing closer, it would be reasonable to anticipate a maiden offtake agreement from a local battery maker could arrive over the coming months.

The signing of an offtake agreement is a clear cause for a company’s share price to re-rate – US lithium developer Piedmont Lithium (ASX: PLL) is a testament of this.

Piedmont signed a sales agreement with Tesla (NASDAQ: TSLA) in late September 2020 and is now capped at over $1BN. Piedmont also recently listed on the NASDAQ, where EMH has already listed.

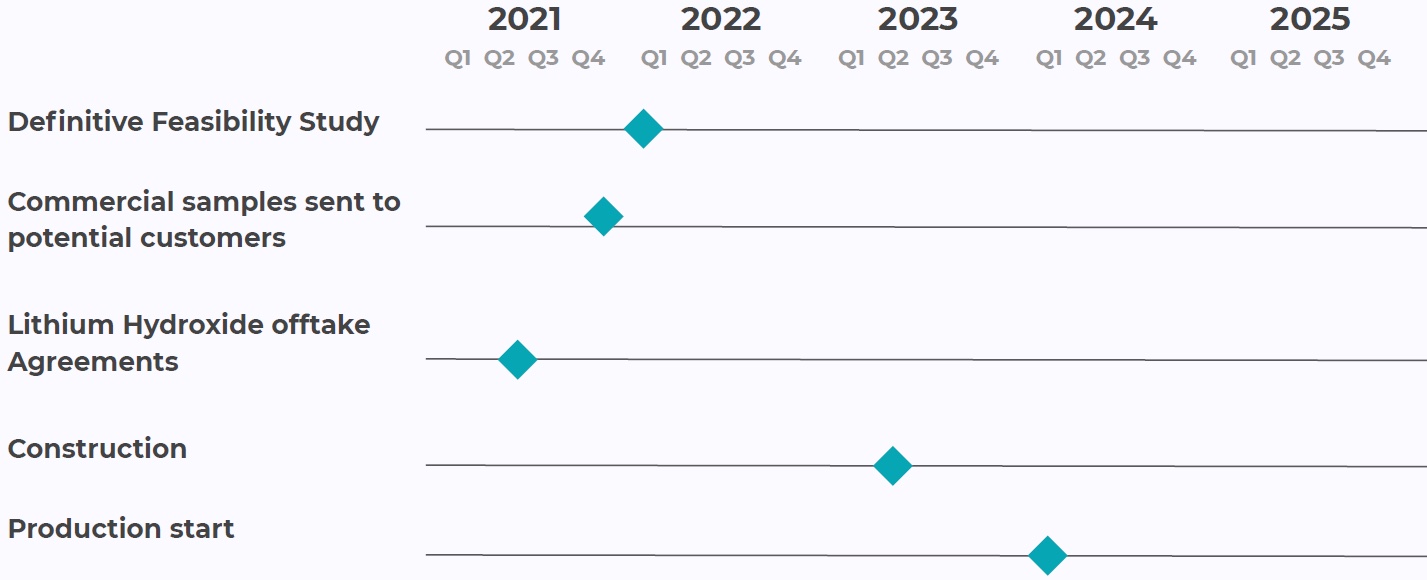

Beyond any sales offtake agreements, by the end of 2021, a Definitive Feasibility Study and Front End Engineering Design should be finalised by EMH.

A key value driver of EMH somewhat out of the company’s hands would be robust growth in the price of lithium as it would impact the project’s economics and bankability.

Cinovec hosts a hard rock lithium deposit with:

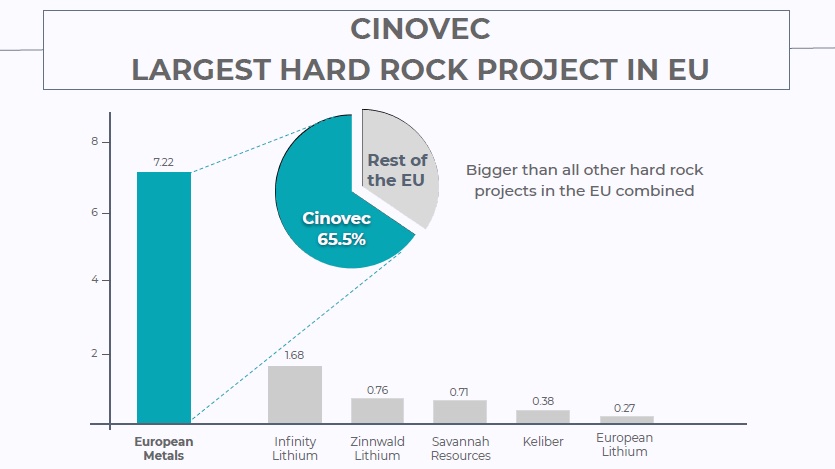

The deposit contains a combined 7.22 million tonnes of Lithium Carbonate Equivalent and 263kt of tin.

An initial Probable Ore Reserve of 34.5 million tonnes at 0.65% Li2O and 0.09% has been declared to cover the first 20 years mining at an output of 22,500 tonnes per annum of lithium carbonate.

As illustrated below, Cinovec is by far the largest hard rock lithium project in Europe.

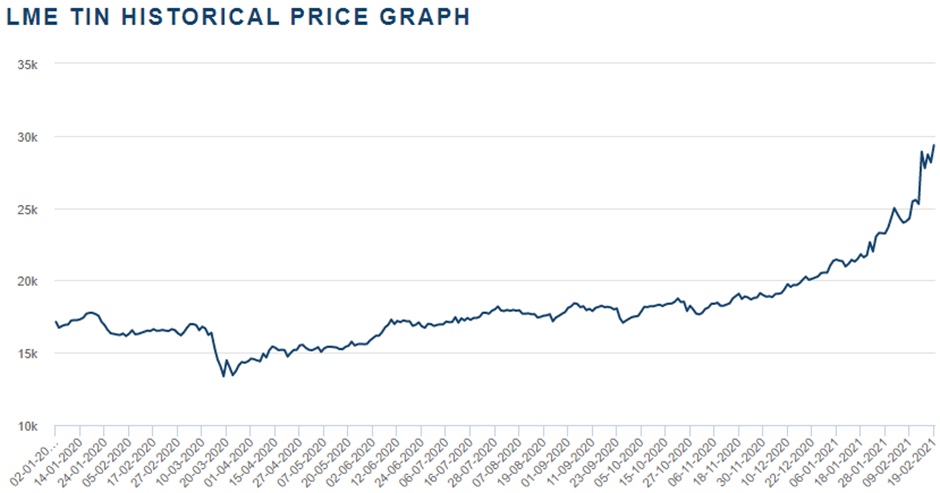

At 263 kt, the tin resource is also globally significant. EMH aims to use revenues generated from tin production at Cinovec to lower the operating costs of producing both lithium hydroxide and lithium carbonate.

The Preliminary Feasibility Study (PFS), conducted by specialist independent consultants indicated a post- tax NPV return of nearly US$1.2 billion (NPV 8% discount) and an IRR of 28.8%.

The assumed battery grade lithium hydroxide price in the updated June 2019 PFS was $12,000/tonne.

The PFS verified that the Cinovec Project is a potential low operating cost, producer of premium battery grade lithium hydroxide or battery grade lithium carbonate as markets demand.

It also confirmed the deposit is amenable to bulk underground mining, and metallurgical testwork has produced both battery grade lithium hydroxide and battery grade lithium carbonate in addition to high-grade tin concentrate at excellent recoveries.

The latter is important, particularly given the recent surge in the tin price, a factor that will assist in driving down production costs.

The Cinovec deposit is covered by three Exploration Permits and three Preliminary Mining Permits (PMP) that cover a combined area of nearly 19 square kilometres.

EMH’s strategy is to combine the three permits and progress the mine permitting and environmental studies that will support the proposed definitive feasibility study (DFS).

Cinovec is centrally located for European end-users and is well serviced by infrastructure, with a sealed road adjacent to the deposit, power to site and rail lines located 5 kilometres north and 8 kilometres south of the deposit.

The project company Geomet s.r.o. controls the Cinovec project’s mineral rights and is owned by EMH (49%) and CEZ (51%).

As part of coming into the project, a payment of €29.1 million by CEZ resulted in the Cinovec project being fully funded to the decision to construct. This paved the way for the project to become the first European Union producer of battery grade lithium compounds from a local lithium resource.

CEZ is the seventh largest European Union power utility by customers and the tenth biggest by market cap (US$13 billion), domiciled in the Czech Republic. The company’s operations are located in western, central, and south-eastern Europe.

The Czech Republic Government is CEZ’s largest shareholder with a 70% stake in the group.

While CEZ owns 51% of the project, there is a JV nature to the operational control, whereby the operational management is made up of executives from both shareholders.

EMH has effective operational control through the business plan set out before the EMH-CEZ investment deal.

Given EMH’s project partner is 70% owned by the Czech Republic’s government, this would likely prove beneficial in terms of the regulatory progression to production.

The Czech Republic Government’s 70% stake in CEZ is a significant aspect of the ownership and operational structure as it could well prove beneficial in terms of progressing the Cinovec Project.

With CEZ as a strategic partner, EMH’s project appears to have solid support from the Czech government and regulatory authorities, with few delays to date in applying for and being awarded various permitting requirements for studies that support the Definitive Feasibility Study.

As one of the leading Central European power companies, CEZ intends to develop several projects in areas of energy storage and battery manufacturing in the Czech Republic and in Central Europe.

Of significance in terms of European Metals’ focus on the electric vehicle and renewable energy industries is CEZ’s market leading position in E-mobility in the region.

The group installs and operates a network of EV charging stations throughout Czech Republic, and the automotive industry in the Czech Republic is a significant contributor to GDP with the number of EV’s in the country expected to grow exponentially in coming years.

In fact, CEZ is heading a consortium to build a lithium-ion battery factory in Czech Republic, so there is a clear strategic intent to help steer EMH’s project into production.

Independent industry analyst Roskill is expecting demand for lithium next year to increase significantly with carbonate to reach 165,000 tonnes LCE, up from 139,000 tonnes in 2020, while demand for hydroxide should total 132,000 tonnes LCE.

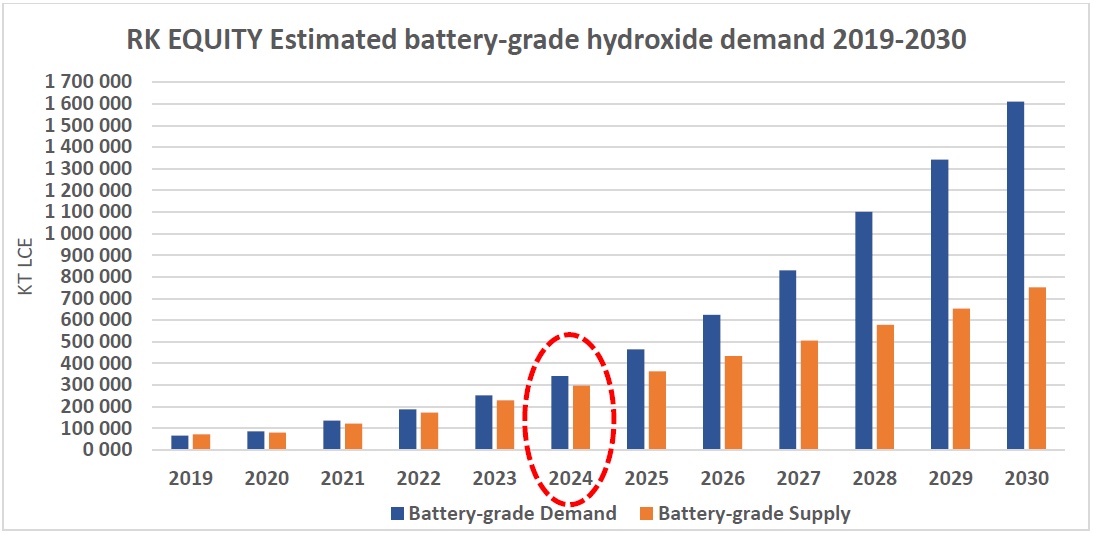

EMH expects to commence production in 2024 as the supply/demand dynamics for the battery grade hydroxide market look set to drive prices higher over the coming decade.

The economic viability of Cinovec has been further enhanced by the recent strong increase in demand for lithium and tin globally, and within Europe specifically.

While the tin price has surged, analysts are particularly focused on the forward outlook for lithium hydroxide and lithium carbonate with the former being a particularly valuable input commodity for the electric vehicle industry.

When running the ruler across European Metals, WH Ireland analyst Paul Smith said, ‘’Security of supply and a scalable project constitutes the prize offered to Europe as the EU supports the development of the next generation of EVs and begins the transition to a carbon neutral future.

‘’The location of Cinovec gives EMH a strategic advantage as Europe looks to insist legally on a fully functioning lithium raw material supply chain from ground to car (and recycling).’’

Smith noted that EMH had adapted its plan for final product to lithium hydroxide in June 2019 in response to battery manufacturers turning to this compound as feedstock for batteries as it offers better power density (a bigger battery capacity), faster charging, longer life cycle and enhanced safety features.

As a superior product for a high-growth market, Smith believes that lithium hydroxide continue to fetch a premium to lithium carbonate (+15-20%).

In part, the demand side of the lithium equation will be driven by an increase in CO2 compliance in the European Union that will commence in 2025.

It is just part of the regulatory stimulus for the renewable energy sector with the European Union committed to investing €550 billion in climate change initiatives between 2021 and 2027.

The immediate objective is to create a competitive manufacturing value chain in Europe with sustainable battery cells at its core.

Another driver of EV sales and lithium demand in Europe is the legislated or proposed ban on the sale of new diesel or internal combustion engine (ICE) vehicles in the major auto markets by 2030.

Of further significance for EMH is the EU’s goal of becoming self-sufficient in terms of lithium production, and by 2025 regulatory bodies are aiming for 80% regional production.

Further initiatives include the establishment of a €40 billion ‘Just Transition Fund’ aimed at assisting in the transition from fossil fuels to green energy.

Management not only prides itself on producing a commodity to meet green energy needs, but it is also cognisant of its ESG (environmental, social, governance) responsibilities.

The single roast, low heat process outlined in the PFS minimises the use of power, and a combination of recycled water and the use of benign reagents adds up to environmentally friendly production.

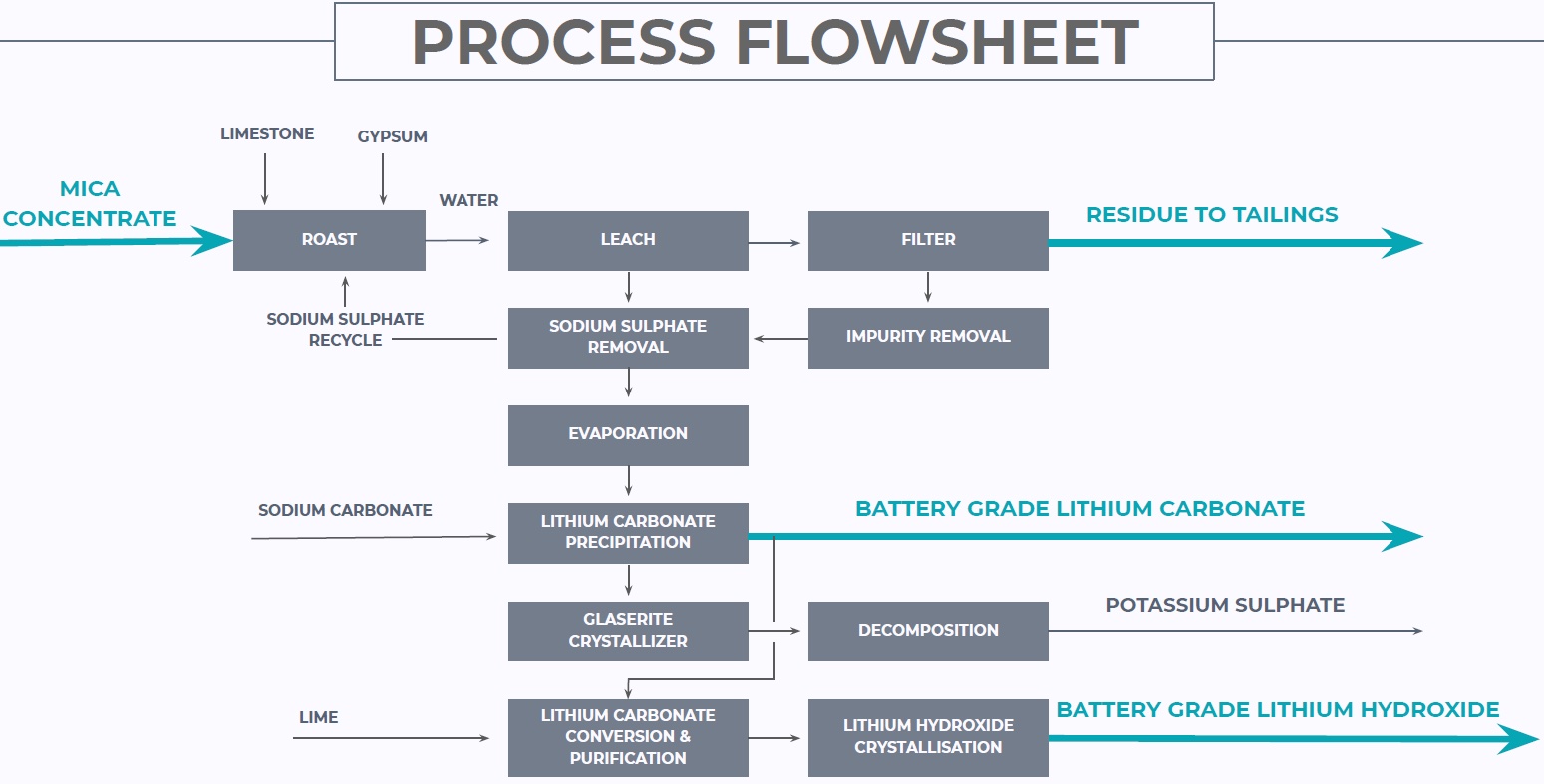

As indicated below, the application of EMH’s process also provides the company with options to produce battery grade lithium carbonate or lithium hydroxide, opening up multiple markets and which translates to client diversification.

The production of lithium hydroxide or carbonate will be via gypsum and sodium sulphate roast, water leach, purification, and production precipitation route.

A by product will be gravity recovery of tin and tungsten, whilst there will also be potash and sodium sulphate by-products from the lithium plant. Tailings disposal will be in adjacent abandoned coal pits.

A combination of regulatory support and industry demand looks set to drive lithium prices higher, and RK Equity noted that this has had a positive impact on the projected returns for the Cinovec Project relative to the PFS which was updated in June 2019.

The analyst is forecasting a higher long-term forecast price for battery grade hydroxide of US$13,000 per tonne compared with the PFS assumption of US$12,000 per tonne.

However, projected upfront capital expenditure has also increased, but the forecast after-tax net present value of more than $1 billion makes this a sizeable project, particularly for a company with a market capitalisation of about $200 million.

It is worth noting that these figures relate to a base case production scenario of 25,000 tonnes per annum (49% attributed to EMH), but both management and RK Equity believe there is scope for doubling production which would double underlying earnings from US$105 million to US$210 million.

However, using the base case scenario and taking into account the following peer comparisons, RK Equity has arrived at a valuation of $2.91 per share, implying upside of 104% compared to yesterday’s close price of $1.40 .

Catalysts that we believe will see the company realise a re-rating in the near to medium-term include the completion of a definitive feasibility study (DFS) which should occur in the next 12 months.

With management sending samples to potential customers in 2021 there is the likelihood of end users negotiating offtake agreements, particularly given that analysts are already predicting supply constraints.

As indicated below, with lithium hydroxide being such a premium product there is even the potential for offtake agreements to be negotiated at an earlier stage.

The definitive feasibility study will be an important milestone in terms of the company progressing to construction, a catalyst in its own right.

Completion of the DFS also positions management to consider financing options, and positive support that would de-risk project development often results in positive share price re-ratings.

Consequently, we see EMH as a compelling play in the green energy materials sector, particularly given the location of the Cinovec Project which is not only strategically positioned in terms of its potential client base, but it also benefits from being situated in a mining friendly jurisdiction.

This is particularly important given that several other major lithium projects are situated in South America and China where sovereign risk and remote location issues can have a detrimental impact on development, access to funding and even reliability of supply once projects come into production.

With regard to confidence in supply, China’s reputation as a reliable source of supply has been marred by internal turbulence, as well as government policy decisions that have triggered a rift between trading nations.

As has been evidenced in Australia, many countries are buying and selling into alternative geographic regions rather than doing business with an unpredictable trading partner.

All of these factors play into EMH’s hands, indicating that the group’s location in its own right contributes to its attraction as a green energy investment.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.