Profile: Vulcan Energy Resources Ltd (ASX:VUL; FRA:6KO) is a dual listed mineral exploration and renewables company trading on the ASX under the code “VUL” and on Frankfurt Stock Exchange under the code “6KO”. Aiming to become the world’s first Zero Carbon Lithium® producer, Vulcan is targeting production of a battery-quality lithium hydroxide (LiOH) chemical product as well as geothermal heat and energy from subsurface brines, all with net zero carbon footprint. The company’s primary asset is the Vulcan Zero Carbon Lithium® Project in Germany’s Upper Rhine Valley, well positioned to help meet the growing needs of the world’s fastest-growing lithium market — the European EV and Li-ion battery market.

With a vision to deliver a project with a net zero CO2 footprint as part of its ESG, Vulcan is targeting the production of lithium hydroxide by 2024, preceded by a number of high-impact value drivers and key milestones.

The recently completed Pre-Feasibility Study (PFS) marked a key milestone on Vulcan’s path to production, providing enhanced clarity around anticipated project economics. The Company is now working to complete a Definitive Feasibility Study (DFS) that’s on track for a 2022 completion and is seeking commercial offtake partners.

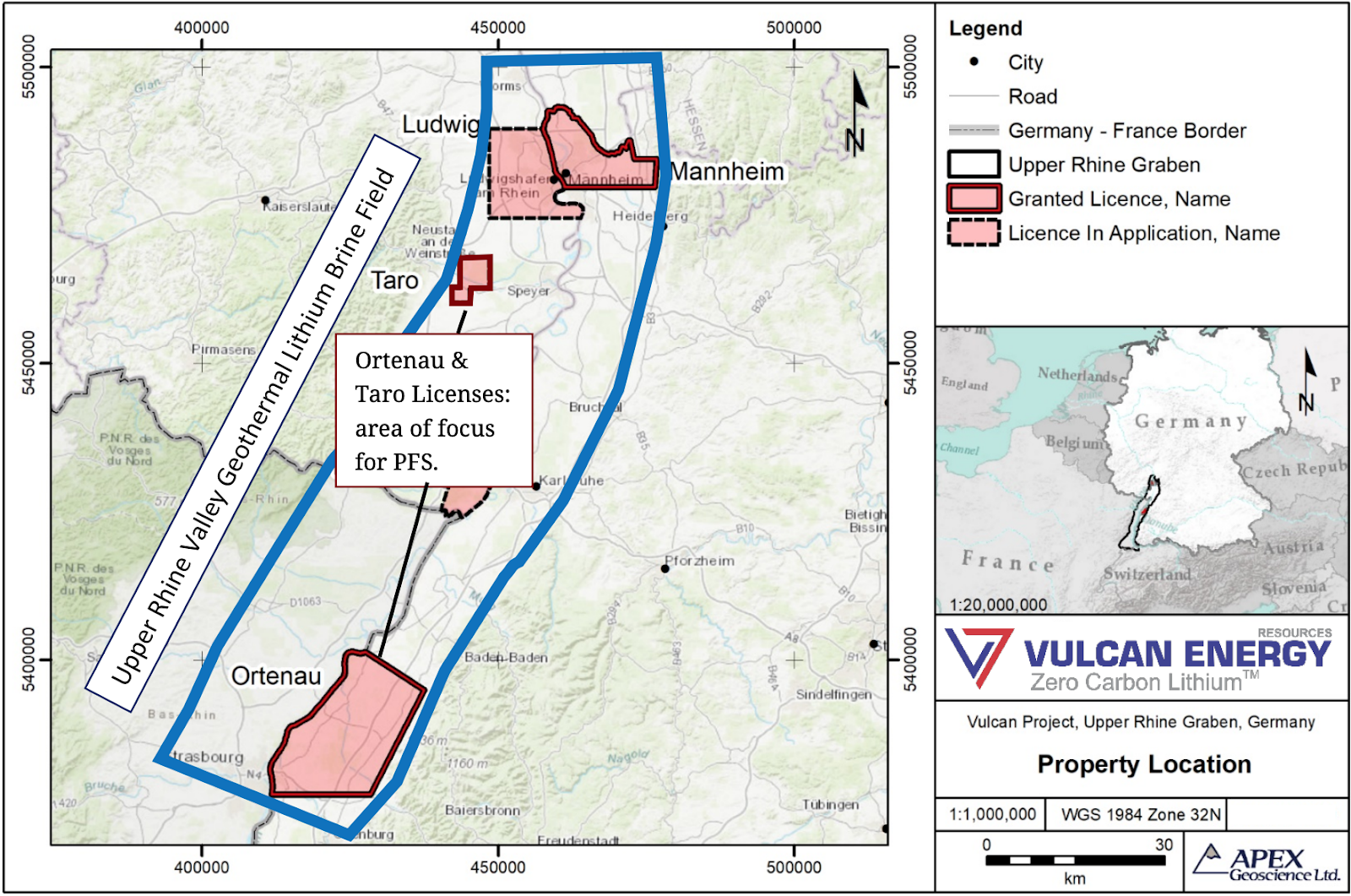

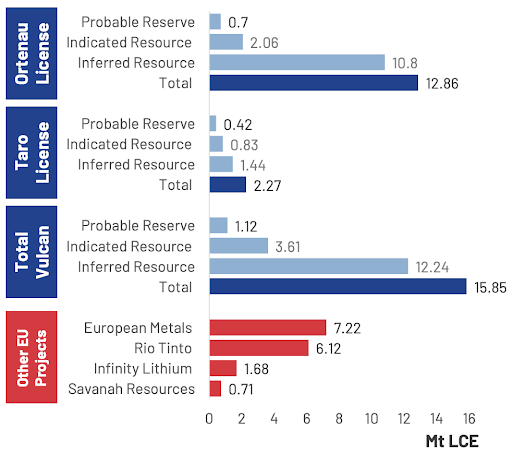

The Vulcan Zero Carbon Lithium® Project has an extremely large, licensed package of more than 1,000km2 in an area uniquely endowed with lithium-rich geothermal brines in the Upper Rhine Valley, close to Stuttgart in the federal state of Baden-Württemberg. Vulcan’s Upper Rhine Valley Li-brine resource collectively contains 15.85 Mt lithium carbonate equiv. (LCE) at a grade of 181 Mg/l Li (Indicated & Inferred, 90% of which is in the Inferred Resource category) across its Taro and Ortenau license areas, making it the largest JORC lithium resource in Europe by far. Given the size of the project area and the Resource, VUL will have options to scale up its operations. This would involve adding more wells and renewable energy plants to meet industry demand.

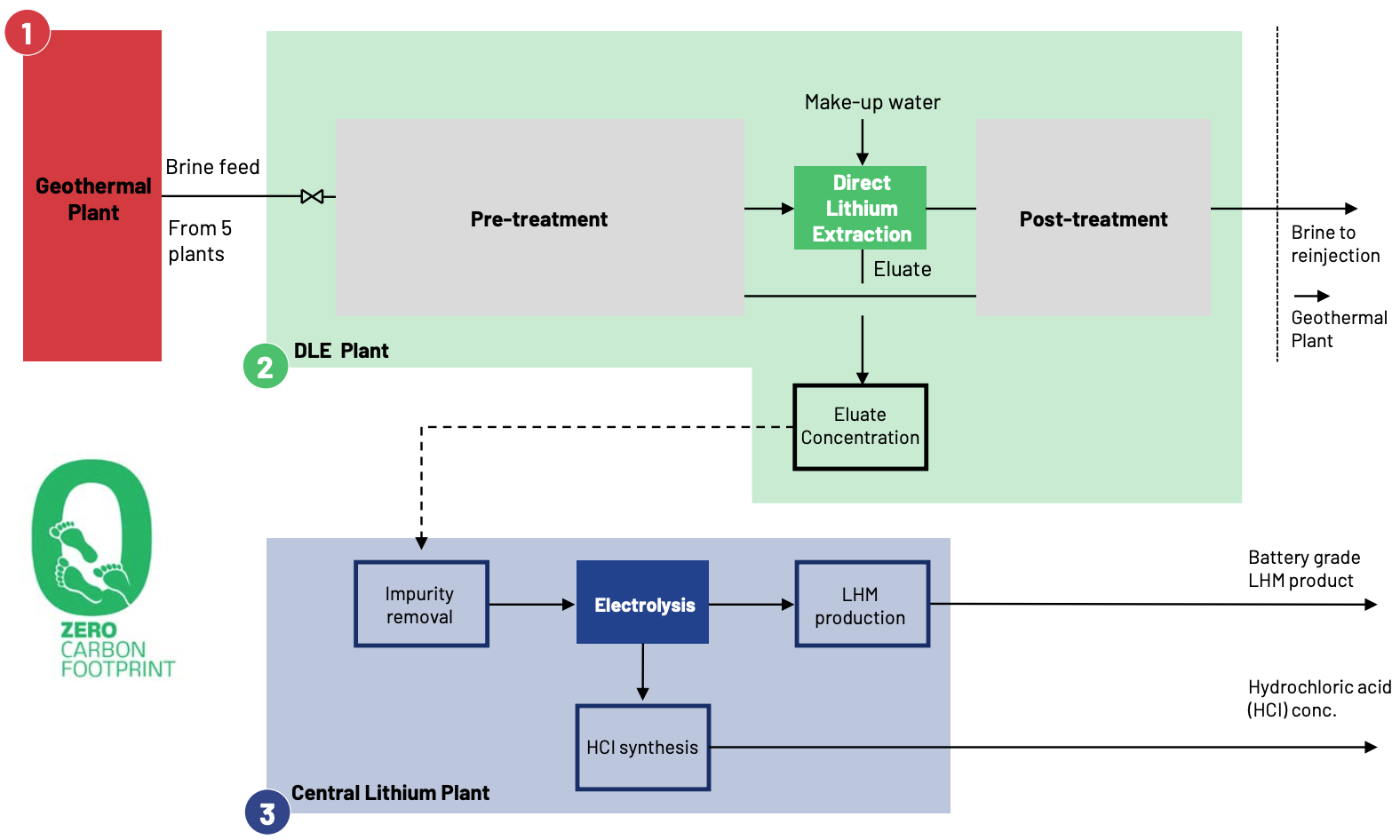

Vulcan plans to extract lithium from brine using geothermal power, via a process that generates zero net carbon emissions.

It draws on naturally occurring, renewable geothermal energy to power the lithium extraction process and create a renewable energy by-product. This uses no fossil fuels, requires very little water and has a tiny land footprint. The production process can be broken into three steps, as illustrated in the flowchart below.

Key operational and corporate developments since our last coverage (23 November 2020):

17/02/2021 – Agreement with DuPont to advance Zero Carbon Lithium

15/02/2021 – Acquisition to consolidate strategic license holding

12/02/2021 – Gina Rinehart confirmed a substantial shareholder

10/02/2021 – Acquisition of world-leading geothermal team, GeoThermal Engineering GmbH (GeoT)

04/02/2021 – $120 Million Placement endorses Zero Carbon Lithium

01/02.2021 – Geothermal project expert joins VUL as COO & VUL joins Lithium ISO standards committee

29/01/2021 – Quarterly Cashflow & Activities reports

15/01/2021 – Positive Pre-feasibility Study

21/12/2020 – German Legislation Embraces Geothermal Energy

15/12/2020 – Updated Ortenau Indicated and Inferred Resource

11/12/2020 – Proposed new European Commission regulation on batteries & CO2 footprint

25/11/2020 – Company AGM

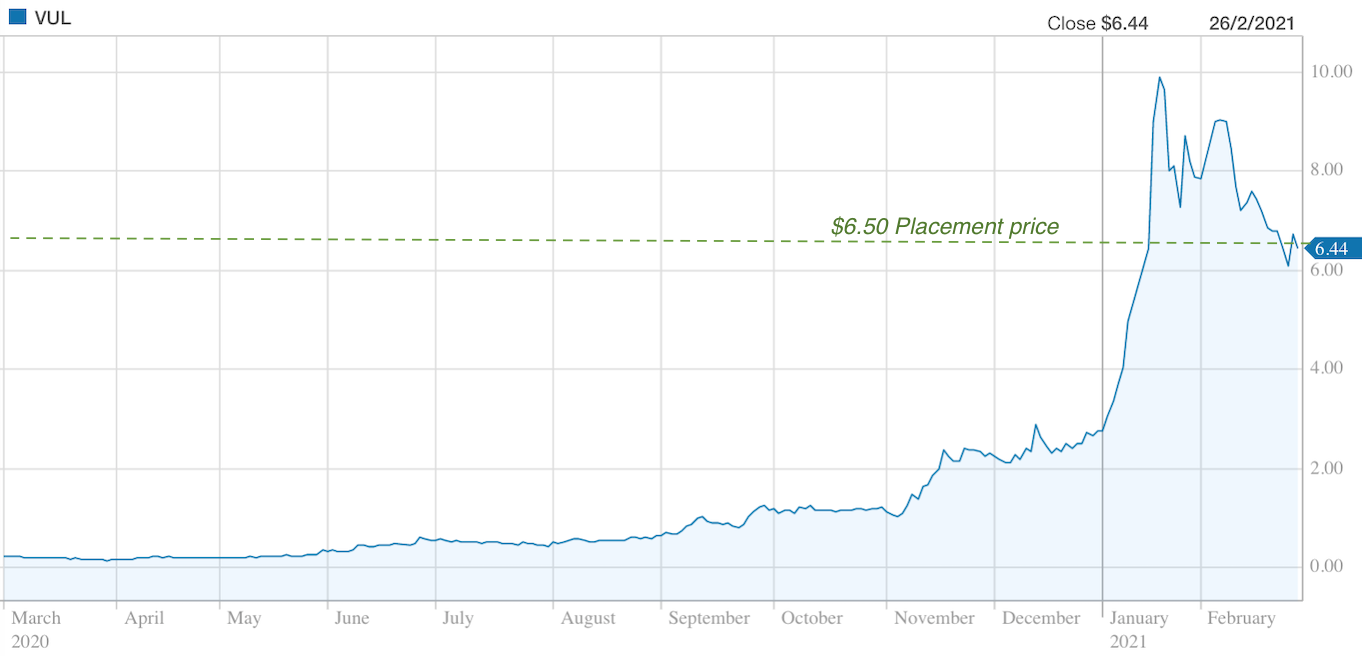

Given the steady flow of positive news, particularly over the past three months, Vulcan is up 2,762% on the ASX in the past year.

The share price climbed steadily in the months leading up to the release of the PFS in mid-January and rallied hard on the news.

Following the recent $120M capital raise, the share price has drifted back down to the Placement price ~$6.50 per share. This provides retail investors with a chance to pick up shares around the same discounted price that was offered (and oversubscribed) to institutional investors.

Wise-owl reaffirms the positive stance outlined coverage of the stock was initiated in June 2020 and reviewed in November. The company’s share price has increased from $0.34 when we initiated coverage on 1 June, 2020, to A$6.44 on 26 February, 2021 and has been as high as A$14.20.

European Lithium Demand

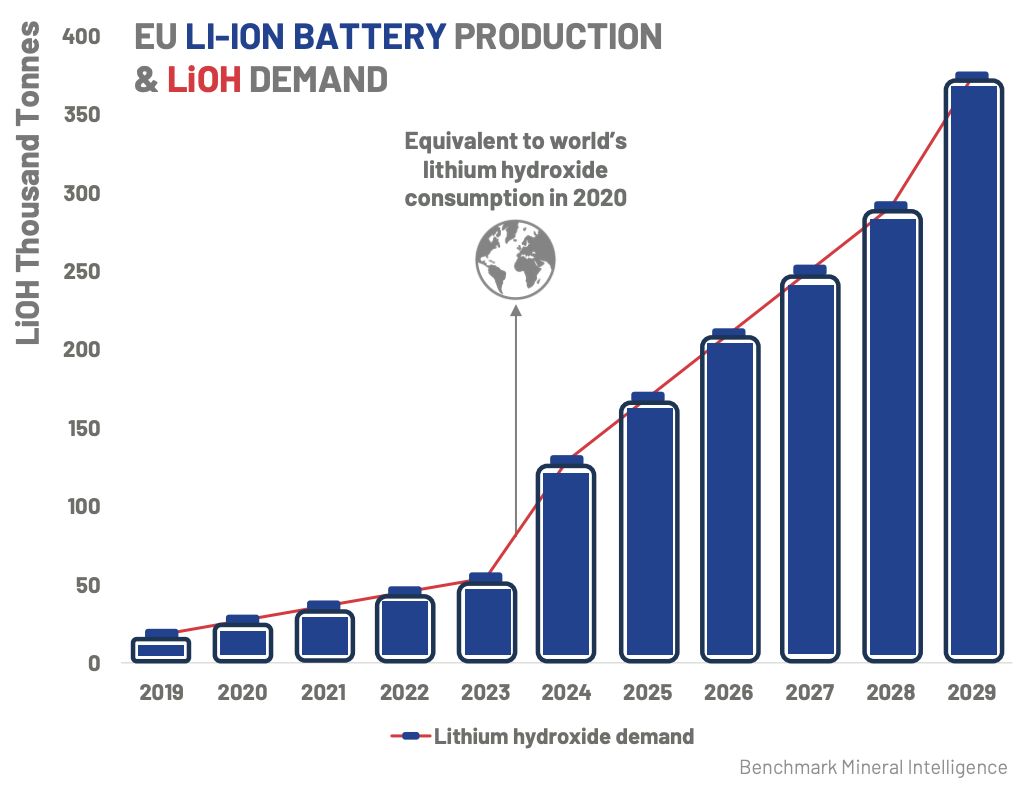

Europe is expected to become the second largest producer of Li-ion batteries in the world. Its Li-ion battery capacity is expected to grow 50 times from today’s level, from around 10GWh to almost 500GWh by 2030. By 2023-24, EU lithium hydroxide demand will surpass the world’s total consumption in 2020.

Post COVID-19, European governments and the EU have put together a range of plans and incentives to support the auto industry, especially the electric vehicle industry. France is also offering a €13,000 EV incentive, the most generous in Europe, while Germany offers up to €9,000 per EV and will force all petrol stations to provide electric car charging.

There’s also new legislation aimed at sustainable battery production. The new mandatory procedures ensure sustainable and ethical sourcing of raw materials including lithium. From January 2026, lithium-ion batteries in the EU will have to bear a carbon intensity performance class label and from July 2027, they must comply with maximum carbon footprint thresholds. Batteries not meeting the new regulation will be banned and manufacturers will have to demonstrate that they are sourcing raw materials responsibly. All battery raw materials batteries will have to be procured according to OECD recognised guidelines for sustainable sourcing. Using blockchain technology, each battery will have a digital passport tracking all components upstream.

In the medium to long term, fundamentals remain strong for electric vehicles and energy storage. Growth rates are expected to average 25% per year over the next 10 years, while supply is growing at a slower rate, leading to a deficit from 2024 onwards. Furthermore, thanks to changes in cathode technologies, by the mid 2020s, lithium hydroxide (LHM) is forecast to take over lithium carbonate as the preferred battery material.

With this rising EV demand, there are multiple battery mega-projects now progressing in the EU:

On the cathode side:

However, Europe currently has zero local supply of lithium hydroxide. The EU and the European Commission have publicly stated that Europe needs to develop a strategic value chain for manufacturing EV and lithium-ion batteries in Europe and secure access to raw materials such as lithium. Vulcan’s unique Zero Carbon Lithium® process will produce both renewable geothermal energy and lithium hydroxide from the same deep brine source. This positions it to address the EU’s challenges in dealing with a very high carbon and water footprint of production, and current total reliance on lithium imports, mostly from China.

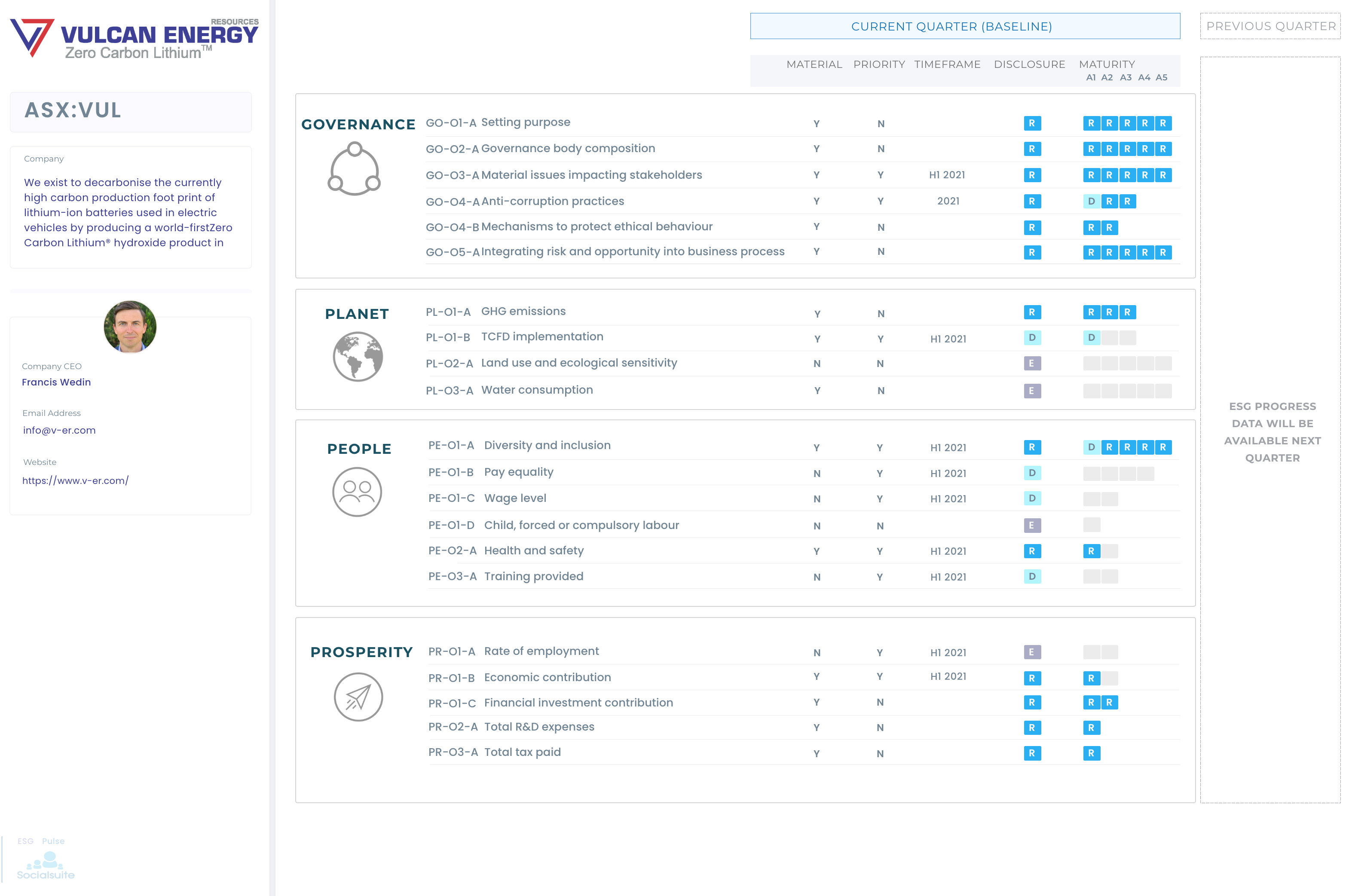

Vulcan’s resource could satisfy a substantial portion of Europe’s needs for the electric vehicle transition, from a zero-carbon source, for many years to come which would further strengthen the company’s ESG credentials as seen below in the following SocialSuite ESG report.

In the recently completed PFS two project scenarios were modelled:

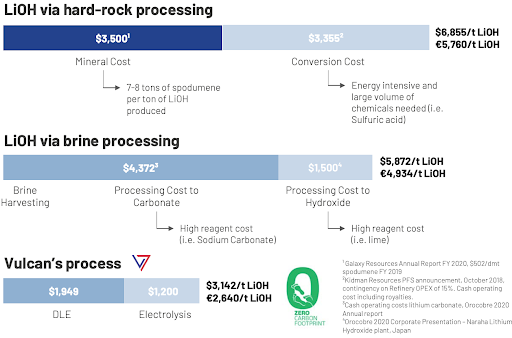

Under the first scenario, the PFS indicates a project value of €2.25 billion (NPV, post-tax), which equates to A$3.54 billion. Under the second scenario, the project has post-tax NPV of €703 million (A$1.1B) in Phase 1, and a post-tax NPV of €1.4 billion (A$2.2B), in Phase 2.It also has the lowest operating expenses (OPEX) of any lithium hydroxide (LHM) project globally at €2,640/t LHM. The combined renewable energy-lithium project pre-tax IRR of 26% and post-tax IRR of 21%. (Lithium as a separate entity from energy shows pre-tax IRR of 31% and post-tax IRR of 26%.) The dual operation is expected to produce 74 MW of renewable energy generation and approximately 40ktpa LHM production.

Sensitivity analysis demonstrates robust project economics, while the geothermal energy part of the project is supported by favourable feed-in tariff and recent German parliament support for geothermal. Also helping project economics is higher forecast lithium contract prices.

Institutional Placement raises A$120M

Vulcan raised A$120 million (before costs) in February 2021 through a strongly supported placement at A$6.50 per share to a suite of ESG-focused institutions. Goldman Sachs and Canaccord Genuity acted as Joint Lead Managers. Cornerstone investment was provided by Hancock Prospecting, which is led by Australia’s richest person, Gina Rinehart. The placement was strongly supported by international and domestic ESG-focused institutions with significant investment provided by the BNP Energy Transition Fund, a European ESG-focused institution. The funding will support Vulcan through to final investment decision at its Zero Carbon Lithium® Project, with proceeds being applied to:

Recent appointments

Vulcan’s management team has a strong track record of value creation and deep experience in developing geothermal brine projects, leaving it well equipped to advance a project of such magnitude. Building on its expertise, Vulcan is acquiring geothermal subsurface consultancy company GeoThermal Engineering GmbH (GeoT), a highly credentialed, world-leading scientific team with over a century of combined expertise in sub-surface development of geothermal projects, from exploration to production drilling.

Also joining Vulcan, as Chief Operating Officer, overseeing the development of the Zero Carbon Lithium® Project is geothermal project expert Mr Thorsten Weimann. Weimann has +25 years’ experience in geothermal project development and operation in Germany, with a strong track record since 2007 of successful geothermal project execution as CEO of Global Engineering & Consulting GmbH.

Additionally, Vulcan’s Lithium Product Manager Dr Katharina Gerber has joined the German National Committee of ISO/TC 333 that coordinates the standardisation process in the field of lithium chemicals at national level and is responsible for organising German participation in standards work at European and international level.

DuPont collaboration

In an important de-risking strategy for the DLE component of the Zero Carbon Lithium® project, Vulcan will be collaborating with DuPont Water Solutions, a leader in water filtration and purification, to test and scale up Direct Lithium Extraction (DLE) solutions for its Zero Carbon Lithium® extraction process. DuPont will be developing and testing an integrated DLE process for Vulcan’s brine. It will leverage its portfolio of proprietary DLE products to assist Vulcan with input and test-work during the project DFS. The agreement is in line with Vulcan’s strategy to test and pursue commercially mature DLE products from major suppliers for its project to minimize technical risks and accelerate development of the project.

Catalysts: Vulcan owns Europe’s largest lithium brine resource, in the centre of the world’s fastest-growing lithium market, with potential for further upside across its five licence areas. Following the completion of the PFS and securing A$120 million in funding, this year we can expect multiple potential share price catalysts. Accelerated development of the project continues as Vulcan conducts Definitive Feasibility Study (DFS) work ahead of its targeted completion in 2022. Other activities include project permitting, lithium extraction test-work scale up, and advancing discussions with European lithium off-takers, all ahead of anticipated first production in 2024.

Vulcan is perfectly positioned to supply the growing number for auto and battery manufactures as the EU transitions towards its goal of net zero carbon emissions by 2050. Vulcan’s ambitions are supported by EU and German legislators who have specifically highlighted the need to reduce the carbon intensity of battery supply chains. In addition to its lithium sales, VUL has geothermal energy as a second expected revenue generator and intends to produce Zero Carbon Heat to be sold to public and private customers via pipes; and Zero Carbon Electricity to be sold to the grid.

The location of the Upper Rhine Valley and immediate proximity to commercial customers offers various advantages with respect to logistical costs and supply chain efficiencies. Combined with the substantial size and attractive grade of the resource, the project makes a compelling case that should assist Vulcan in procuring offtake and finance arrangements to advance the project.

Hurdles: While Vulcan has made great strides in recent months, the Company remains at an early stage of its resource development and considerable further technical investigations are required to de-risk the project. The recent positive PFS, along with institutional support for the Placement, has enhanced our comfort with the project, however, the PFS did rely on a number of assumptions. Vulcan has yet to drill a geothermal production well and several assumptions have been made in the resource estimation process including Li-brine concentration and average porosity of the resource domains. Within the project area, both DLE and Conversion Plant sites are still to be selected. The PFS assumes a flat greenfield site with services at the site boundary and no piling or blasting required. There is also a degree of risk and uncertainty associated with exploring for and exploiting fault zones as geothermal and Li-brine reservoirs. There is presently no commercial lithium hydroxide production via electrolysis — testwork and selection of vendors with appropriate experience will mitigate this risk. But the lower risk option to produce LHM via the “traditional route”, with a lithium carbonate step and then liming is an option. Vulcan has performed limited testwork at this stage of engineering, with multiple areas relying on benchmarks, simulations, literature, or vendor experience for process definition and costing. This is to be mitigated with additional laboratory and pilot scale testwork.

While the company recently secured $120 million from institutional investors, including a cornerstone investment from Gina Rinehart’s Hancock Prospecting, procuring finance remains a key factor. There is no guarantee that funds can be procured at favourable terms and the ability to develop the project depends on the future availability of funding. The approvals process also presents numerous regulatory approvals at various stages.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.