An Australian microcap company in Province Resources (ASX: PRL) – formerly ScandiVanadium Ltd – is shooting for the stars, aiming to develop the country’s first truly Zero Carbon Green Hydrogen project. While achieving this goal would be no mean feat, management has definitely demonstrated that it has its finger on the pulse in measuring global sentiment for such a commodity.

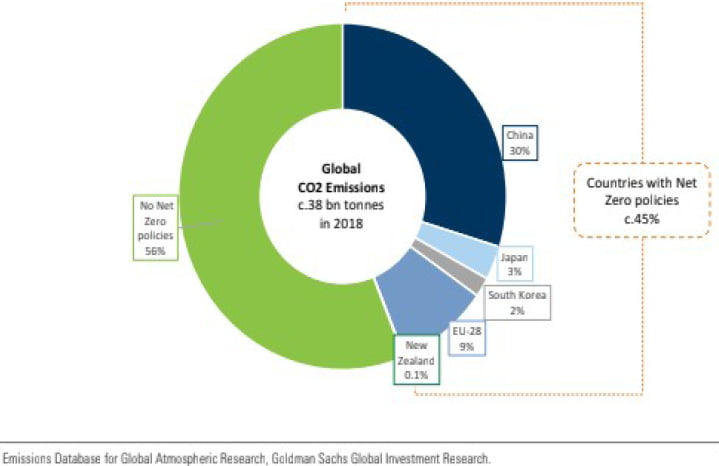

On the back of climate commitments in Europe and Asia, nearly half of the globe has already embraced net zero policies; further, early statements from the pending new US Administration appear encouraging.

The globalisation of net zero policies could imply a circa 200% capital expenditure acceleration for global utilities (circa €40 trillion of investment in renewables and power grids to 2050; €1.3 trillion per annum).

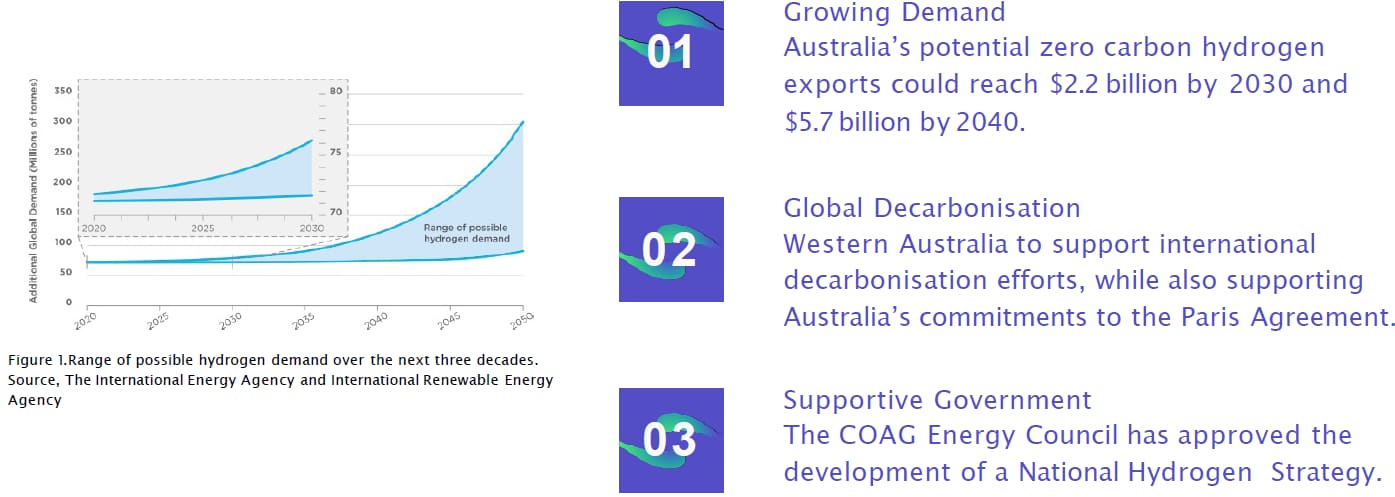

For climate experts, green hydrogen is indispensable to climate neutrality. It features in all eight of the European Commission’s net zero emissions scenarios for 2050.

Strong government regulatory support backed by corporate financing

Not surprisingly, there is strong support for such projects at a corporate, government and retail investor level.

Governments and corporations are selling the increasingly popular ESG (environmental, social, and governance) related bonds to the tune of nearly $500 million and Moodys expects 2021 sustainable debt issuance to reach $650 billion.

In our own backyard we have one of Australia’s most successful entrepreneurs in Andrew ‘Twiggy’ Forrest saying:

“Green hydrogen gives Australia an opportunity to slash our emissions – and if we get this right, the impact could be nothing short of nation-building.’’

The iron ore magnate has been extremely successful because he knows a good project when he sees it, meticulously scoping out the market and developing the most efficient means of producing a premium product.

Now he realises that green steel is the way of the future, and recently highlighted that hydrogen is one of the simplest forms of energy generation, with the process being to run electricity through water to separate the hydrogen and oxygen.

Province is at the very beginning of its journey. Just like any resources project, it is all about scale, and a large project could generate extremely high economic returns on the back of minimal operating costs.

We like Province Resources because it may just be the next company that can emulate another emerging Zero Carbon commodity developer in Vulcan Resources (ASX: VUL), a company that delivered one of the best share price performances on the ASX in decades as its shares increased by more than 5000% in the 12 months to January 19, 2021.

Bear in mind, it was just this month that another iron ore magnate and Australia’s richest person with an estimated fortune of about $29 billion (AFR Rich list 2020) Gina Rinehart emerged as a substantial shareholder in Vulcan Resources.

Harking back to government initiatives, $300 million has been injected into the Australian Government Advancing Hydrogen Fund.

Discussing the benefits of hydrogen production, Hon Alannah MacTiernan MLC Minister Assisting the Minister for State Development, Jobs & Trade said,

‘’Hydrogen provides a means to harness our world-class solar and wind resources for energy export, and help our international partners meet emissions reduction goals.’’

This is how Province Resources sums up the opportunities that lie ahead, but we will flesh the story out in more detail as we examine how the company is going to tackle developing such a project.

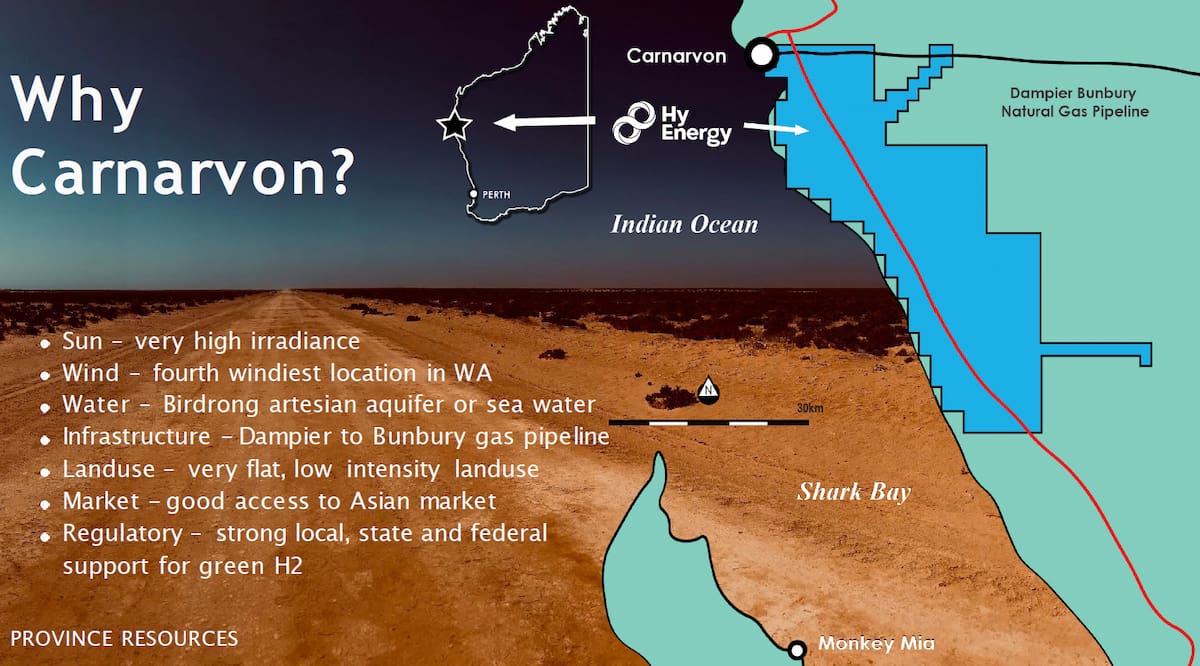

There are a number of reasons why Western Australia is the location of choice for Province.

Western Australia’s solar is amongst the highest irradiance in the world and, due to being on the western edge of the continent, it has excellent wind resources.

With an area of 2.5 million square kilometres, representing one third of the Australian continent, Western Australia is well placed to develop large-scale renewable energy generation.

The State also benefits from low intensity land use and low population density.

Having important existing infrastructure is another key benefit, particularly the Dampier Bunbury Natural Gas Pipeline and world-class industrial and export infrastructure that can accommodate the development of the hydrogen industry.

As home to many other large resource projects, governments and corporations have already established deep relationships with important global partners and the related collaborative globally competitive supply chain benefits can be drawn on by Province.

Western Australia’s geographical proximity to Asia and its long-term presence in these markets is another strategic benefit.

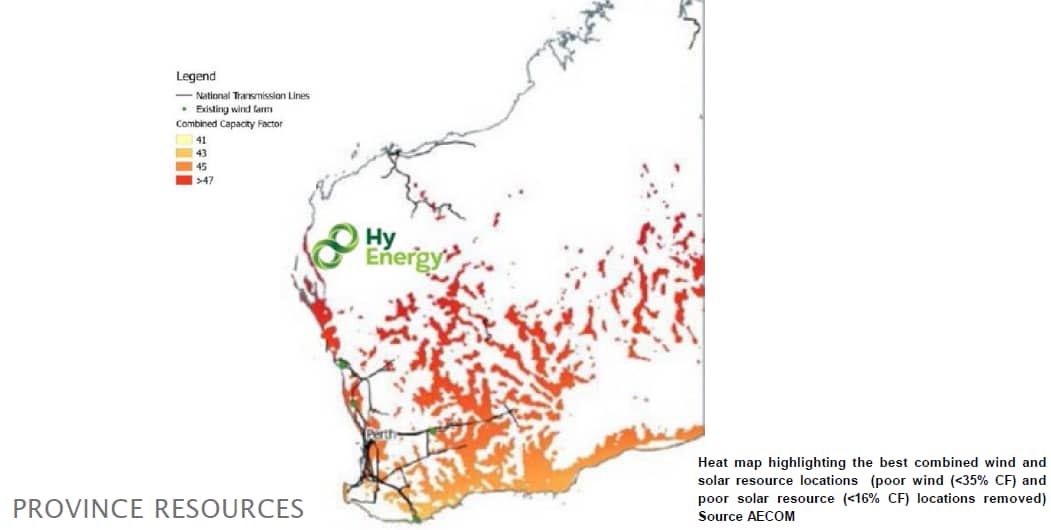

More specifically, Province is targeting Carnarvon, and as indicated below that region has the natural resources, land characteristics and existing infrastructure to host such project.

Province noted that the HyEnergy Carnarvon Basin project site in the Gascoyne region in Western Australia has world class solar and wind resources.

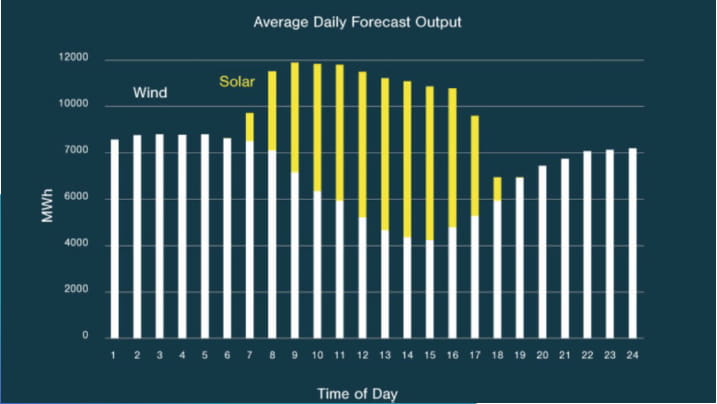

Those resources are perfectly complementary, with a high incidence of sun during the daytime and high wind speeds in the morning, evening and night.

This enables competitively priced predictable and firm renewable electricity output, 365 days a year.

Carnarvon’s annual mean wind speed of 25.5 kilometres per hour makes it the biggest location in Western Australia.

Existing windfarms at Denham and Coral Bay are operating at proof of concept stage in the Gascoyne region.

The Western Australian state government has committed $8 million to funding the Denham Microgrid renewable hydrogen project.

Large-scale wind farms have also been planned in Pilbara’s ‘Cyclone Alley’ where cyclones crossing the coast are prevalent, and this will support the Carnarvon region as a preferred lower-risk wind farm location.

Of the solar front, Carnarvon has a very rich solar resource averaging 211 sunny days per year, with an average solar exposure of 22 MJ/m2 /day (or 6.24 kWh/m2/day).

Once again, very low competing land use and a high solar resource as illustrated below makes the project area ideal for a large-scale solar array network.

Province has substantial studies and fieldwork to complete in the near term that will pave the way for the company to move to development if the project is proven as bankable.

Management will be executing a heritage agreement with the Yinggarda Aboriginal Corporation (YAC) to govern the conduct of site resource monitoring investigations.

Discussions will also need to be held with a number of other key stakeholders, including the Carnarvon Shire and Community, the Western Australian government, and the Federal government.

A precursor to embarking on the necessary operational-related milestones such as feasibility studies will be a search for expertise and high-level corporate acumen to strengthen the group’s board and management.

In terms of time frame, management expects to commence feasibility studies for both renewable power generation and green hydrogen production within the next 12 to 18 months.

In tandem with this, it is expected that a binding memorandum of understanding with an independent power provider can be executed in order to develop the renewable power required for the hydrogen plant.

Discussions can commence at any stage in the near term with potential off-takers, including the owners of the Dampier to Bunbury gas pipeline, Australian Gas and Infrastructure Group.

The Zero Carbon Renewable Hydrogen Project is proposed to be developed in stages.

Stage I should see the foundation and demonstration of an advanced priority pilot trial of green energy and green ammonia production in the Carnarvon region.

The second stage should involve gas blending with a scale-up project to feed into the nearby Dampier Bunbury Natural Gas Pipeline.

This should assist the Western Australian government in meeting its objective of up to 10% green hydrogen in the pipeline by 2030.

The optimum end-game would be full-scale production to supply Asian markets, as well as multiple markets in Australia.

Subject to customer needs, hydrogen offtake could be either in the form of ammonia or liquefied hydrogen.

A key element of Australia’s approach will be to create hydrogen hubs to meet clusters of large-scale demand.

These may be at ports, in cities, or in regional or remote areas, and will provide the industry with its springboard to scale.

Hubs will make the development of infrastructure more cost-effective, promote efficiencies from economies of scale, foster innovation, and promote synergies from sector coupling where there are reciprocal benefits between industries.

These will be complemented and enhanced by other early steps to use hydrogen in transport, industry, and gas distribution networks, and integrate hydrogen technologies into electricity systems in a way that enhances reliability.

Some notable related advantages that distinctly align with ESG themes are job creation, increased demand for existing renewable energy projects, and the environmental benefits of supplying green energy.

Whilst it appears to stand alone on the ASX in terms of an early-stage green hydrogen stock, Province isn’t the only enterprise eyeing off the development of a renewable hydrogen project in Western Australia.

This is important when you consider the size of the other players that are well advanced with studies that have proven even greater capacity can be achieved than originally thought.

Asia Renewable Energy Hub is backed by CWP Renewables, Macquarie Group, and the world’s biggest wind turbine manufacturer Vestas.

Vestas Wind Systems announced just last week that it had launched the largest offshore wind turbine, nudging out its key rival General Electric.

The diameter of the Vestas 236 wind turbine is 236 metres and it can produce 15 megawatts of power at normal speed.

With regard to the broader project, it had originally aimed for 9GW, but with more studies, it grew to 11GW late last year and is now targeting 15GW.

That represents some $30 billion in investment and the potential to generate some 50 terrawatt hours of electricity a year, roughly equivalent to one-fifth of Australia’s annual electricity consumption, and about twice the current capacity of installed large-scale wind and solar.

The Pilbara Project is positioning itself to be in prime position as the green hydrogen export market takes off over the next decade or two, targeting a renaissance of Australian industry based on cheap and clean power, and also demand from power-hungry north Asian economies such as Japan and South Korea.

They have limited domestic renewable energy sources and find themselves between a rock and a hard place in terms of decreasing their reliance on both locally produced and imported fossil fuels.

There are also plans to develop a massive new renewable hydrogen production facility near Kalbarri in Western Australia, with up to 5,000MW of combined solar and wind projects to supply it.

This has the backing of Denmark Copenhagen Infrastructure Partners (CIP), and Hydrogen Renewables Australia has agreed to partner with CIP on the massive project, which is proposed for the Murchison House Station on the state’s mid-west coast, an area identified by engineering firm AECOM as a prime position for the co-location of wind and solar projects in Australia.

The goal of the project is to use the premium solar and wind energy resources, along with desalinated seawater, to produce renewable hydrogen to Asian markets, with an eye to Japan and Korea.

It is worth noting that Asian investment is central to the aforementioned projects and further it would seem that they also represent the likely destination for the end commodity.

The federal government is already in a bind in terms of China undermining some of our most prominent industries that span both agricultural and mining resources.

Consequently, it would be surprising to see a project such as that proposed by Province not receive strong support at all levels of government, particularly given the multiple benefits of improving our renewable energy profile, creating jobs, and promoting self-sufficiency in the vital area of energy supply.

An Australian-built project that commits to supplying Australian consumers first would be a great vote winner.

While this is a proposed project that should be considered in the infancy stage rather than the early stage, the size of the prize is huge.

Often, small companies trying to emulate the success of big players in proven growth industries find it difficult to compete and fall by the wayside.

Province is a different story in that it is looking to progress this potential project at such a time that it could be considered an early mover, an advantageous position in terms of attracting investor interest (including government investment) and tapping into high-demand markets.

The timing couldn’t be better in terms of demand growth as it is being driven by global and local government commitments to renewable energy, industry developments such as vehicles that will be able to run on renewable hydrogen, and a seemingly unquenchable thirst from capital investors.

Even retail investors and entrepreneurs in Australia have demonstrated their support for these types of projects with a case in point being Vulcan’s Zero Carbon Lithium, as we discussed earlier and in our previous reports on Vulcan.

This is crucial in terms of weighing up Province’s investment profile as multiple funding sources will be required to develop such a project.

Similarly, there would need to be government and regulatory support through the various permitting stages, and it could be argued that the project would be a ‘’where there’s a will, there’s a way’’ story from a government perspective.

Being such an early-stage project, this underlines the “investment view” in a succinct, but very compelling way.

As the company progresses through the various milestones from regulatory and permitting approvals through to feasibility studies and hopefully financing and development, the investment view will take on many more facets.

However, suffice to say that Province is shaping up as a news flow-driven story in a hot sector, suggesting that the achievement of important milestones could result in a Vulcan-type share price rerating.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.